AUB partners news

"We have raised interest rates for long-term agreements: by 0.5% for nine-month agreements and by 1.5% for annual agreements. The new terms will be especially interesting for those clients who have already invested in this instrument and trust the company. After all, they have already received their payments - on time, in full, to their NovaPay account,” comments Igor Prikhodko, CFO of NovaPay. ”NovaPay securities are a great opportunity to diversify sources of passive income even with a minimum investment of UAH 1000.

Current rates as of October 15, 2024:

- 1 month - 10%;

- 2 months - 14%;

- 3 months - 15.5%;

- 6 months - 16.5%;

- 9 months - 17%;

- 12 months - 18%.

During the sale, more than 2,600 Ukrainians purchased NovaPay bonds for about UAH 600 million.

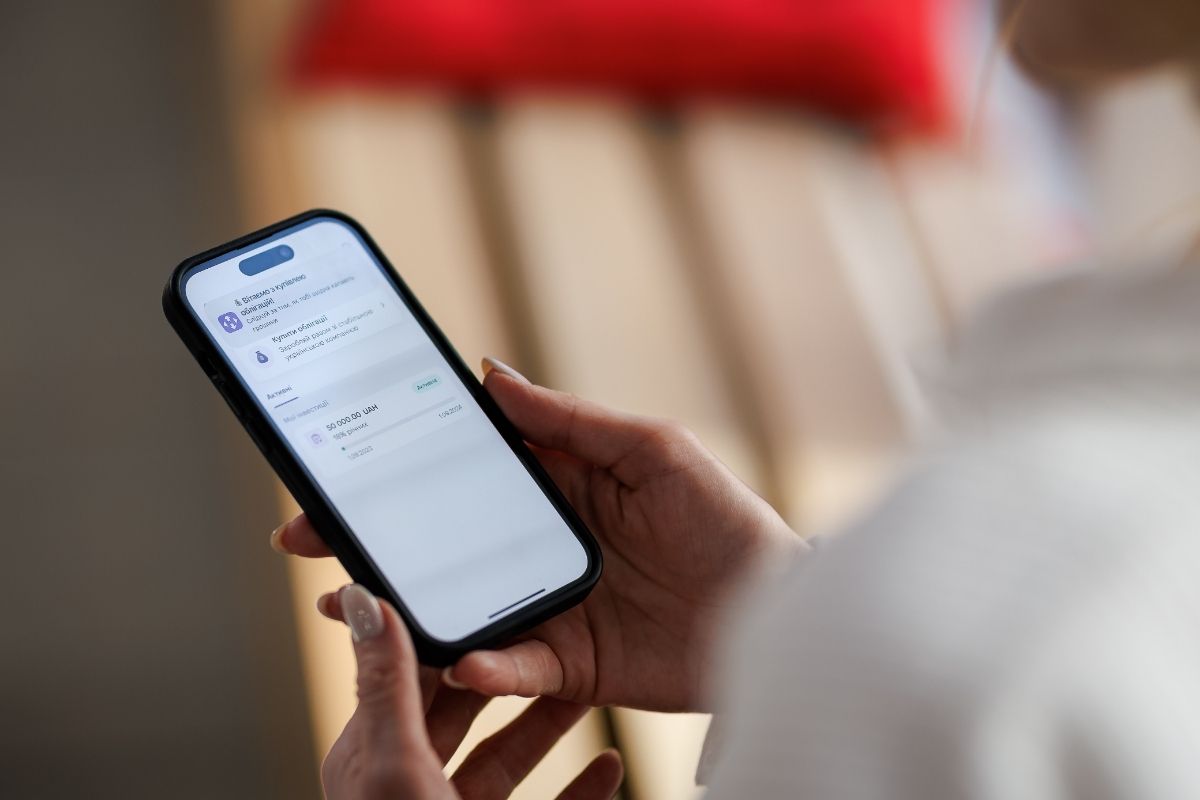

Securities can be purchased in the NovaPay mobile application in a few minutes. To do this, you need to

- select the “Savings” section on the home screen and click “Buy bonds”;

- select the terms and conditions: the term and amount of investment;

- confirm the application, sign the documents using Diia.Signature and pay for the bonds. When the purchase process is complete, the client will receive a push notification.

The app automatically displays the expected payout amount. Upon expiration of the bond purchase agreement, the income will be credited to the client's NovaPay account.

The application automatically displays the expected payout amount. Upon expiration of the bond purchase agreement, the income will be credited to the client's NovaPay account.

Last year, NovaPay registered three public issues of interest-bearing bonds of series A, B, and C for UAH 100 million each. In 2024, the company issued three more issues of such securities - series D, E, and F. The Standard Rating Agency has affirmed NovaPay's corporate bonds with a uaAA credit rating, the highest among Ukrainian financial institutions.

* The bonds are issued by NovaPay Credit LLC.

In the first half of 2024, PRAVEX BANK noted a significant increase in the popularity of the program, which allows customers to enjoy the comfort of airport business lounges around the world. According to the Bank, every fifth active user of Visa Signature premium cards used this service to access comfortable business lounges around the world.

Most often, the bank's customers chose business lounges in Poland, Italy, Moldova, Spain and Turkey, which became the leaders among the popular destinations. The list of frequently visited countries also includes the UK, UAE, Austria and Hungary.

Access to comfortable business lounges is one of the key advantages of PRAVEX BANK premium cards. Travelers can take advantage of free snacks, drinks, fast Wi-Fi and special areas for relaxation or work, which creates ideal conditions while waiting for flights.

Holders of Visa Platinum, Visa Platinum Business and Visa Signature cards have the opportunity to visit more than 1300 business lounges around the world for free.

You can learn more about the available lounges and apply for a premium card through the PRAVEX ONLINE mobile application or by contacting PRAVEX BANK consultants.

In the first half of 2024, PRAVEX BANK noted a significant increase in the popularity of the program, which allows customers to enjoy the comfort of airport business lounges around the world. According to the Bank, every fifth active user of Visa Signature premium cards used this service to access comfortable business lounges around the world.

Most often, the bank's customers chose business lounges in Poland, Italy, Moldova, Spain and Turkey, which became the leaders among the popular destinations. The list of frequently visited countries also includes the UK, UAE, Austria and Hungary.

Access to comfortable business lounges is one of the key advantages of PRAVEX BANK premium cards. Travelers can take advantage of free snacks, drinks, fast Wi-Fi and special areas for relaxation or work, which creates ideal conditions while waiting for flights.

Holders of Visa Platinum, Visa Platinum Business and Visa Signature cards have the opportunity to visit more than 1300 business lounges around the world for free.

You can learn more about the available lounges and apply for a premium card through the PRAVEX ONLINE mobile application or by contacting PRAVEX BANK consultants.

In more than 2 months from the start of preferential energy lending programs, Globus Bank issued 55 loans for a total amount of UAH 42 million. Among them, 26 loans were issued to private households in the amount of UAH 10 million, 13 loans in the amount of UAH 14 million were granted to small and medium-sized businesses, and 16 loans in the amount of UAH 18 million were financed by condominiums participating in the "Energodim" and "GreenDIM" programs from of the Energy Efficiency Fund, including condominiums and condominiums within the framework of the state program "Affordable Loans 5-7-9".

Such data was provided by Dmytro Zamotaev, director of the retail business department of GLOBUS BANK.

The banker noted that energy loans were issued in 16 cities of Ukraine, in particular in Rivne, Poltava, Vinnytsia, Cherkasy, Zhytomyr, Uzhgorod, Ivano-Frankivsk, Dnipro, Odesa, Kharkiv, Sumy, Kyiv, Chernivtsi, Lviv, Lutsk, and Bila Tserkva.In addition, a total of 27 applications are currently being processed for energy loans.According to him, this result can be considered quite acceptable, and the increasing demand for energy loans may eventually transform into the liberalization of credit terms.

"Currently, we are observing a rapid increase in the demand of household owners for such loans — in October, the bank plans to triple the loan portfolio under energy loan programs," Dmytro Zamotaev emphasized.

The expert drew attention to the fact that the main reasons for loan refusals are the borrowers' failure to comply with the terms of participation in the programs. For example, for individuals, this is a high combined monthly income of the family for 6 months, which exceeds the amount of UAH 189,000 stipulated in the program, or the total area of the house is more than 250 m2. On the other hand, for condominiums and condominiums, the refusal of credit happens extremely rarely, because only those organizations that do not have debts / or have insignificant debts to resource supply companies can submit an application.

The banker also announced the list of necessary conditions, compliance with which will guarantee the approval of the energy loan to the potential borrower.

For household owners:

- It is necessary to submit a standard package of documents (passport, code, certificate from the place of work), title documents for the house and a certificate of having a personal account of a household electricity consumer.

- It is necessary to decide on an equipment supplier and submit documents for the purchase and installation of power equipment.

- An energy credit is issued exclusively to the owner of a house whose total area does not exceed 250 m2.

- The combined average monthly income of all family members for the last 6 months should not exceed ten times the average monthly salary in Ukraine. That is, no more than 189,000 hryvnias.

For condominiums or condominiums:

- Decisions/protocols of meetings of members of condominiums and condominiums with decisions on issuing documents for obtaining a loan for the purchase and installation of SES (the decision must be approved by the majority of apartment owners).

- A package of documents: the legal entity's legal entity documents, financial statements, an agreement with the supplier of the equipment that is planned to be installed.

- Condominiums and condominiums, in which the average level of collection of payments for the year is not lower than 85% of the approved estimate, and in which there is no overdue debt to resource supply enterprises, can receive a loan.

"At the same time, condominiums or condominiums can submit documents to the "Energy Efficiency Fund" DU in order to participate in the fund's programs, which provide for compensation of up to 70% of the cost of an energy-efficient project," the expert noted.

The expert pointed to a number of factors that can positively affect the development of energy credit programs. In particular, he noted the following among them:

- Citizens are sufficiently aware of the terms of preferential energy credit and the benefits they receive from installing such equipment.

- An indirect factor: a stable situation in the country's economy and on the foreign exchange market in particular.

- Indirect factor: stable situation with energy supply.

- Indirect "military" factors: from minimizing the consequences of enemy shelling to positive dynamics at the front.

Dmytro Zamotaev

Dmytro ZamotaevDirector of the retail business department of GLOBUS BANK

”

"We live in rather difficult military conditions, and the risks of interruptions in energy supply in the autumn-winter period are quite significant. This factor often forces potential borrowers to make a faster decision to participate in credit programs. Energy independence is a strategy that requires prudence, readiness for rapid and systemic changes. That is why we are quite optimistic: in the coming months, the number of issued energy credits may increase significantly," concluded Dmytro Zamotaev.

Reference:

COMMERCIAL BANK "GLOBUS" JOINT STOCK COMPANY (GLOBUS BANK) was founded in 2007.

As of July 2024, the regional network has 31 branches. All branches of the bank are part of the combined Power Banking network, which allows you to work in the absence of electricity.

GLOBUS BANK has a credit rating of uaAAA on the national scale, as well as a deposit rating of ua2+ on the scale of the Expert Rating agency.

The bank's priority areas of activity are lending to energy-efficient projects, mortgage lending on the primary market, car lending, lending to small and medium-sized businesses.

GLOBUS BANK is an accredited partner of a number of state programs: the state mortgage program "eOselya", the program of preferential lending for small and medium-sized businesses "5-7-9", "Affordable factoring", "Affordable financial leasing 5-7-9", "Energy independence of physical persons - owners of households".

The bank is a partner of the "Energy Efficiency Fund" DU in the lending programs of condominiums and housing cooperatives "Energodim" and "GreenDIM".

The bank is a participant of the "National Cashback" state program.

On June 25, 2024, GLOBUS BANK became one of the 17 largest Ukrainian banks that signed the Memorandum on lending to energy infrastructure restoration projects.

The Chairman of the Board of GLOBUS BANK Serhii Mamedov is the Deputy Chairman of the Board of Directors of the Confederation of Builders of Ukraine and the Vice President of the Association of Ukrainian Banks.

ESA has secured one more loan for Ecosphere for 180 million UAH!

This is the second successful case of cooperation between the Export Credit Agency, Ecosphere and UGB Ukrgasbank.

In 2023, the company has already received EUR 3.5 million of an export loan under the Agency's insurance, and we talked about them here

“ECA and UGB have a large portfolio of joint clients, but Ecosphere is one of the largest and we are pleased that the company continues to use our services.

This proves that ECA insurance really simplifies business for Ukrainian exporters,” says Ruslan Hashev, Chairman of the Board of ECA.

For more information, please visit the ECA website There you will find detailed information about the agency's products, contacts and an application form.

You can also find a plugin to check whether your UKTZED code falls under our terms and conditions. Contact us!

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775