AUB partners news

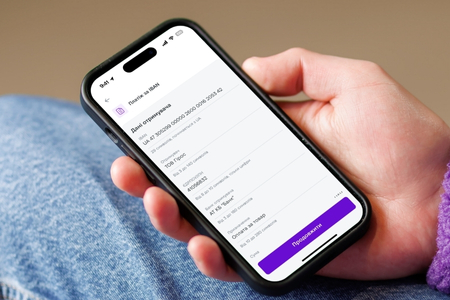

The state affordable mortgage program “єОселя” has reached a new important milestone — more than 20,000 loans (20,024) have already been issued for a total amount of almost UAH 35 billion (UAH 33.615 billion).

Who has benefited from the program?

- 10,124 military and law enforcement personnel (51%)

- 5,142 other citizens who do not own housing (26%)

- 1,528 medical professionals (8%)

- 1,490 teachers (7%)

- 870 internally displaced persons (4%)

- 468 veterans (2%)

- 402 scientists (2%)

The average age of borrowers is 35: - 26–35 years old — 8,599 people (44.2%)

- 36–45 years old — 6,532 people (33.6%)

- 18–25 years old — 1,747 people (9%)

Family size

- Single-person family — 6,386 transactions (32.9%)

- Family with one child — 6,067 transactions (31.2%)

- Two-person family — 3,904 transactions (20.1%)

- Families with two children — 2,767 transactions (14.2%)

- Families with three children — 286 transactions (1.5%)

- Families with four or more children — 23 transactions (0.1%)

- A total of 12,553 children are growing up in their own homes today thanks to the program.

What kind of real estate do they choose?

- The average area per family member is 29.25 m².

- Real estate on the secondary market — 12,132 transactions

- Average cost of housing — UAH 2.25 million

- Average price per m² — UAH 38,800

- Average area — 55.4 m²

- New buildings commissioned — 6,098 transactions

- average cost of housing — UAH 2.41 million

- average price per m² — UAH 40.2 thousand

- average area — 60 m²

- Housing under construction — 1,794 transactions

- Average cost of housing — UAH 2.66 million

- Average price per m² — UAH 44,100

- Average area — 60.2 m²

Geography of the program - Most real estate was purchased in Kyiv and the Kyiv region (49.4% of transactions).

- Kyiv region — 5,577 transactions (27.9%)

- Kyiv — 4,313 transactions (21.5%)

- Lviv region — 1,235 transactions (6.2%)

- Ivano-Frankivsk region — 923 transactions (4.6%)

- Odesa region — 913 transactions (4.6%)

“Every figure in the statistics represents the story of a specific family that has been given the opportunity to live in their own home. These are the stories of veterans, educators, medical professionals, and young specialists who are staying in Ukraine and building their future here,” emphasized Yevhen Metsger, Chairman of the Board of PJSC Ukrfinzhytlo.

Today, 10 banks are participating in the program (AB UKRGASBANK, JSC Oschadbank, JSC CB Privatbank, JSC SENS BANK, JSC SKY BANK, JSC “BANK KREDIT DNIPRO,” JSC “TASCOMBANK,” JSC “CB ”GLOBUS,“ JSC ”BISBANK,“ JSC ”AB ‘RADABANK’), and interest in “eOselya” continues to grow.

Every hryvnia invested by the state through eOselya returns to the Ukrainian budget in the form of almost three hryvnias (2.78 UAH) in taxes and fees.

Ukrfinzhytlo will continue to work to make home ownership a reality for an increasing number of Ukrainians, supporting families and the country's economy.

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775