AUB News

The level of financial literacy among Ukrainians is growing — results of a study by the Association of Ukrainian Banks

The financial literacy of Ukrainians is gradually increasing, but the need for additional knowledge remains relevant. This is evidenced by the results of a representative study conducted by the Association of Ukrainian Banks in conjunction with Research UA and the Institute of Sociology of the National Academy of Sciences of Ukraine in July 2025.

The President of the Association of Ukrainian Banks spoke on the First Public Broadcasting Channel about how Ukrainians' financial literacy is growing, how to use microloans correctly to avoid the debt trap, and why it is important to plan your budget responsibly.

“We have seen a positive trend in how people assess their level of financial literacy and whether they need additional information to understand how to best use credit resources,” emphasized AUB President Andriy Dubas.

Financial literacy: key findings

According to the survey results

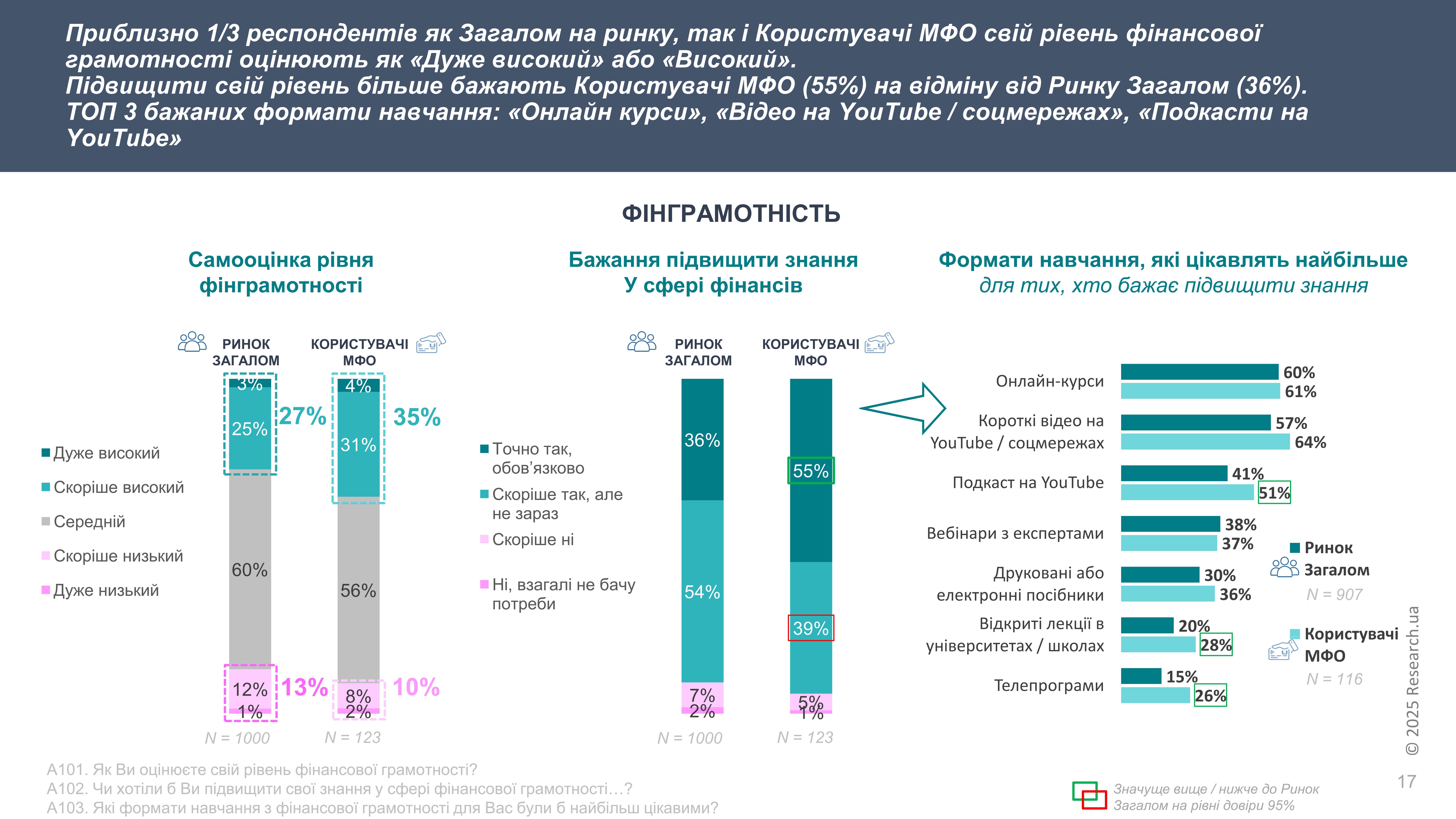

- almost a third of respondents, both in the market as a whole and among MFI users, rate their financial knowledge as high

- 55% of MFI clients and 36% of respondents overall expressed a desire to improve their knowledge

- the most popular learning formats are online courses, videos on social media, and podcasts.

An important positive sign is that 84% of respondents carefully read the terms of the loan agreement before signing it. Only 3% of MFI clients and 6% of respondents in general admitted that they do not read the terms at all. This indicates a more conscious approach of Ukrainians to financial obligations.

At the same time, only 40% of MFI users consider the terms of loans to be completely understandable, which confirms the need to increase transparency and accessibility of information.

According to Andriy Dubas, the non-bank lending market in Ukraine is becoming more mature, and companies are adhering to responsible practices.

“Every credit institution is interested not in problematic loans, but in loans that are repaid, because their goal is to earn interest,” explained the president of the AUB.

At the same time, he stressed that borrowers themselves bear no less responsibility. According to Dubas, loans can be a profitable tool if they help increase a person's efficiency or productivity. At the same time, excessive or impulsive borrowing can lead to financial difficulties.

The AUB president urged Ukrainians to plan their budgets carefully and assess their sources of loan repayment in advance. If unforeseen circumstances arise, the best solution is to contact the lender and agree on an extension or restructuring of the debt.

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775