AUB News

The All-Ukrainian Forum on Financial Technologies of the Association of Ukrainian Banks brought together market representatives and experts

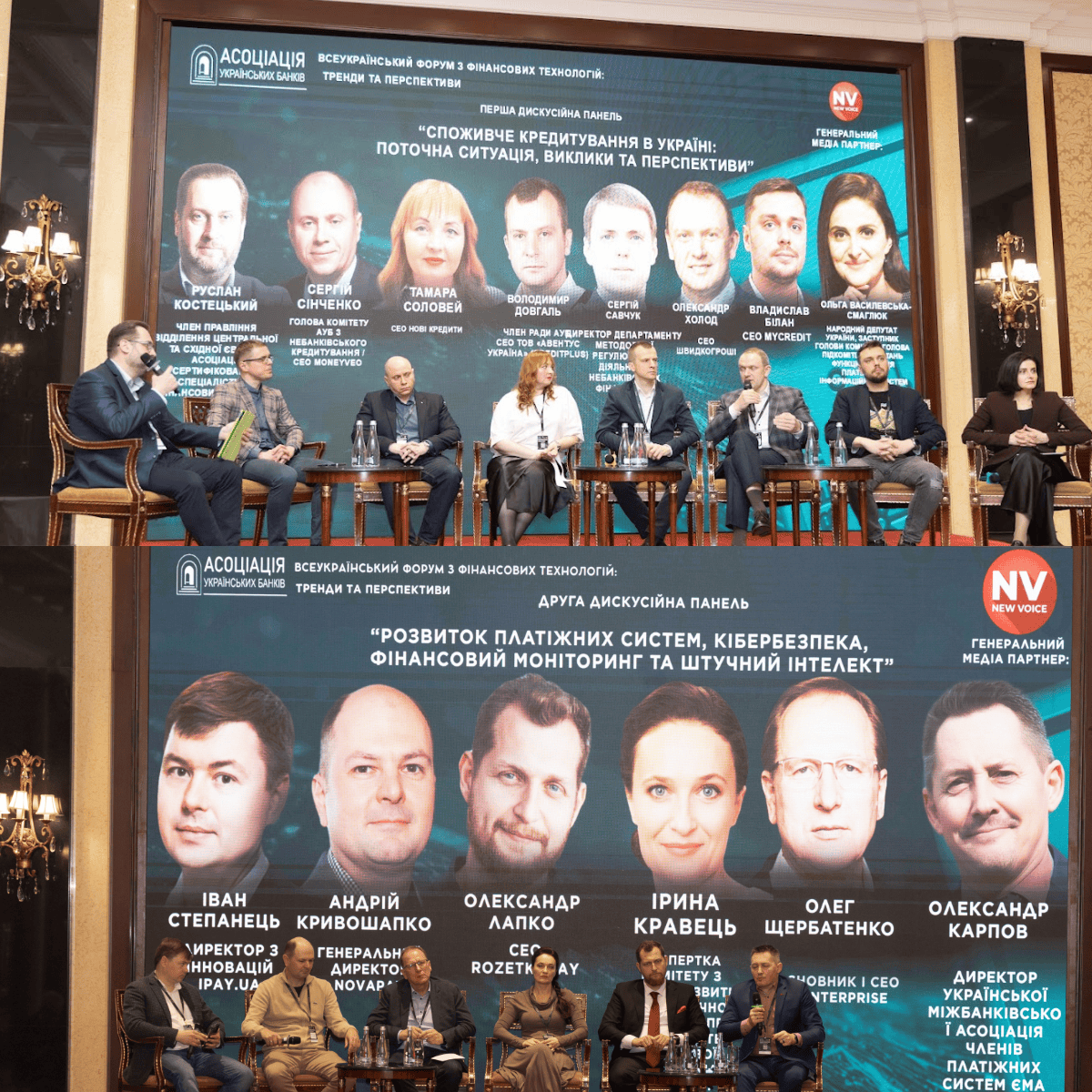

On March 26, 2025, the All-Ukrainian Forum on Financial Technologies: Trends and Prospects, organized by the Association of Ukrainian Banks, was held at the InterContinental Kyiv Hotel. The event became a unique platform for discussing the future of Ukraine's financial sector, bringing together representatives of the Verkhovna Rada, the National Bank of Ukraine, leading fintech companies, and experts in the field of finance and artificial intelligence.

The forum discussed key issues of financial technology development, in particular the impact of artificial intelligence on payment systems and lending, foreign investments in the fintech market of Ukraine, legislative innovations in the field of non-banking financial institutions. Among the speakers of the event were the First Deputy Chairman of the NBU Kateryna Rozhkova, the Head of the Verkhovna Rada Committee on Finance, Tax and Customs Policy Danylo Getmantsev, MP Olga Vasylevska-Smaglyuk, as well as heads of financial and technology companies.

The forum provided a unique opportunity for participants to receive websites from key market players and share practical cases. Kateryna Rozhkova spoke about changes in the field of non-bank consumer lending and the regulator's approaches to the development of non-banking financial institutions, harmonization of regulatory standards with European Union legislation. She also noted that the scope of non-bank lending is increasing, financial companies are already turning into mini-banks, and this creates healthy competition and promotes the development of the financial sector of Ukraine.

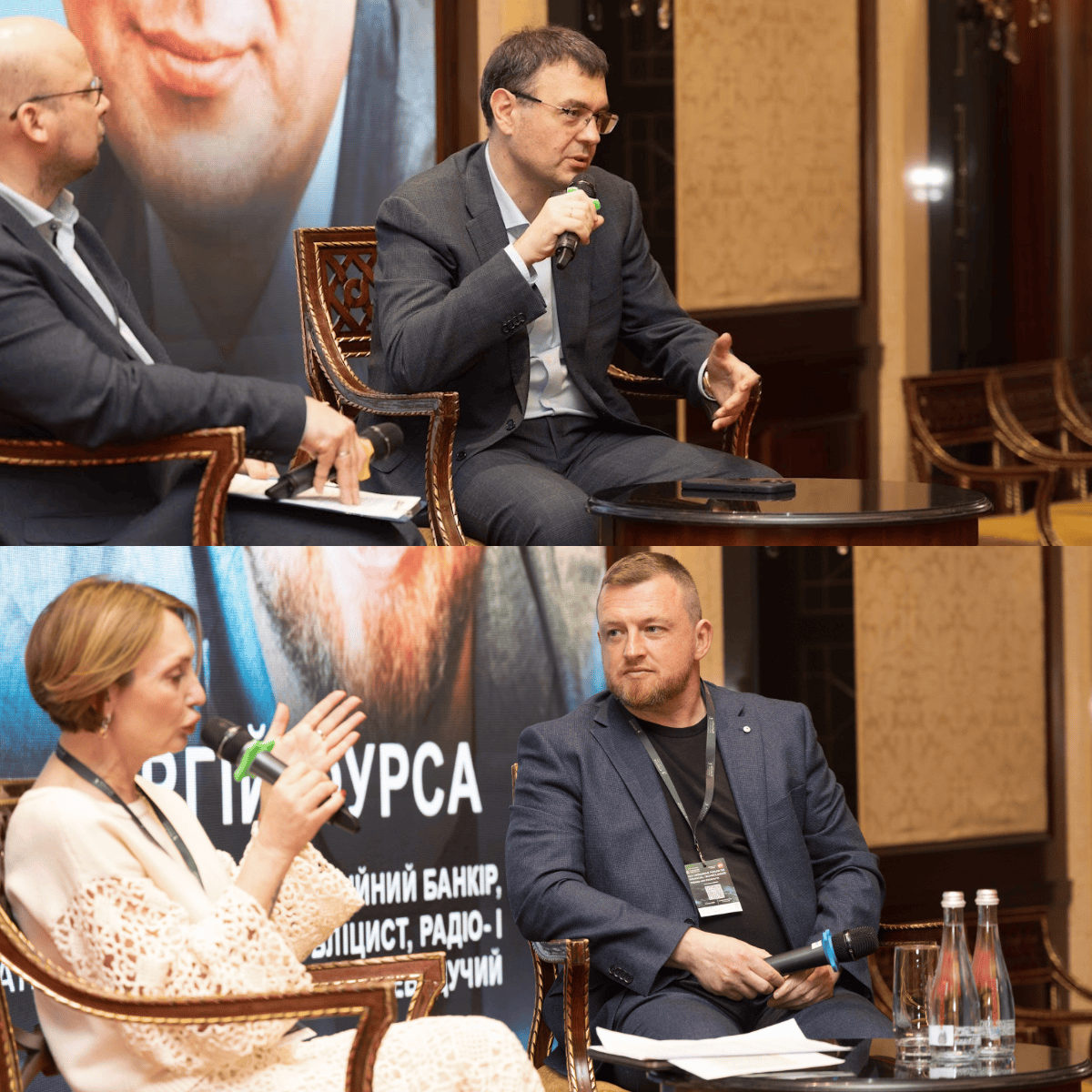

In an interview with the editor-in-chief of Interfax-Ukraine Dmytro Koshov, Danylo Getmantsev outlined the prospects for legislative initiatives in the financial sector, assessing the importance of tax stability and the impossibility of retrospectively increasing profit taxes for banks in 2025.

During the forum, People's Deputy of Ukraine Olga Vasylevska-Smaglyuk presented a bill on reforming the credit history system. She emphasized the importance of unique identifiers, including data on civil status and bankruptcy for a more accurate assessment of creditworthiness and the fight against fraud. The speaker of the work also focused on the standardization of credit history bureaus and strengthening the role of the NBU, which will contribute to market transparency and Ukraine's integration into the global financial system.

The issue of using artificial intelligence in the financial industry attracted particular attention of the participants. Experts discussed how AI is changing approaches to lending, payment transactions, and financial monitoring. Representatives of fintech companies shared their own experience in implementing advanced technologies and analyzed potential risks and challenges.

The event culminated in the signing of the Memorandum on Ensuring Appropriate Lending, which should promote transparency, develop financial inclusion, and create fair conditions for all participants in the financial ecosystem. The conclusion of the Memorandum is the first step towards creating a sustainable financial ecosystem based on transparency, honesty, and trust. This will help increase the financial literacy of citizens by providing clear and truthful information about credit products, reduce the risk of credit risk, which, in turn, will contribute to the financial stability of citizens and the economy as a whole. In addition, the Memorandum will contribute to the formation of healthy competition among financial companies, which ensures improved quality of credit services and more favorable conditions for borrowers. The participants of the event noted that this initiative is a step in production towards international standards of appropriate financing.

The Memorandum also provides for:

- Maintaining a limit of 1% of the daily rate for lending to individuals.

- Using a risk-based approach when assessing the solvency of borrowers.

- Limiting the issuance of loans at night to prevent consumers from making rash financial decisions.

- Transparency and responsibility in cooperation with collection companies, compliance with ethical standards of work with debtors.

- Inadmissibility of ownership or management of financial institutions by citizens of the aggressor country or persons associated with it.

President of the Association of Ukrainian Banks Andriy Dubas noted that the forum was not only a platform for discussion, but also provided an opportunity to establish new business contacts, share expertise and discuss common challenges. In short, AUB will continue to organize similar events for the development of the financial market of Ukraine and the introduction of modern technologies in the financial sphere.

The forum demonstrated a high level of interest from the main players of the financial sector of Ukraine in the development of financial technologies, creating a platform for a productive dialogue between state authorities, financial institutions of the market and technology companies. This further confirmed that Ukraine remains an attractive platform for investors even in the difficult conditions of martial law, and the country's financial sector is confidently moving towards innovation and sustainable development.

A full list of photos of the event is available at the link

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775