AUB News

Veterans in the spotlight: financial sector joins forces for social adaptation of Ukraine's defenders

On October 30, the Association of Ukrainian Banks held a roundtable discussion on “Social Integration and Adaptation of Veterans: the Role of the Banking Sector”. The event brought together more than 40 participants, including representatives of the Verkhovna Rada of Ukraine, the National Bank of Ukraine, the Public Council under the Ministry of Veterans Affairs, the National Defense University of Ukraine, as well as leading banks and non-bank financial institutions. The roundtable provided a platform for discussing important issues of social and economic adaptation of veterans with the help of financial instruments and support from the banking sector.

In his opening remarks, Andriy Dubas, President of the Association of Ukrainian Banks, emphasized the importance of consolidating the financial sector's efforts to support veterans of the Russian-Ukrainian war. He emphasized that veterans should receive not only social but also financial assistance through specialized products and services tailored to their needs. Dubas noted that the development of loyalty programs, accessibility of banking services and support for veteran businesses are key areas to ensure the financial independence of veterans.

Taras Tarasenko, Member of the Ukrainian Parliament and member of the Verkhovna Rada Committee on Social Policy and Veterans' Rights, presented the National Strategy for Veterans' Policy.

He emphasized the significant steps taken at the legislative level to support veterans, including the adoption of the draft law on veteran entrepreneurship in the first reading. The draft law provides for the creation of conditions for business development among veterans, which will facilitate their social and economic adaptation. Tarasenko also emphasized the need to create systemic solutions for veterans at the national level to ensure equal access to services and support regardless of the region.

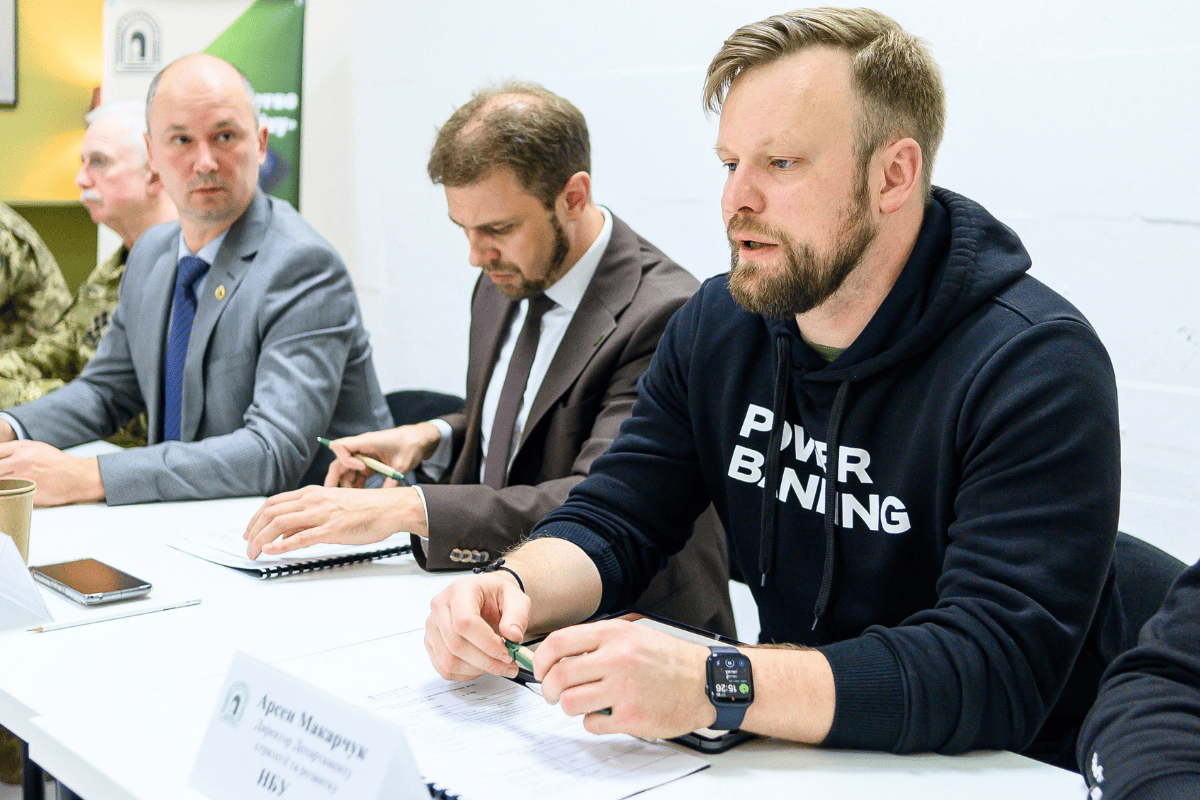

Arsen Makarchuk, Director of the Strategy and Development Department of the National Bank of Ukraine, emphasized the importance of financial inclusion for veterans in his speech. He noted that the NBU is working to expand veterans' access to financial services, especially in the frontline regions. Mr. Makarchuk said that the NBU has already developed a number of methodological recommendations for banking institutions aimed at ensuring inclusiveness and barrier-free financial services for veterans and people with limited mobility. He also emphasized the importance of retraining programs for veterans in the financial sector and plans to expand these initiatives in cooperation with international financial organizations.

Colonel General Mykhailo Koval, Head of the National Defense University of Ukraine, shared his military experience and emphasized the importance of supporting veterans. He noted that the war in Ukraine is extremely difficult, and it is important that those returning from the frontline feel cared for and supported by society. Koval emphasized the need to create a rehabilitation and reintegration system for the military that would take into account the physical, psychological and professional aspects of their recovery.

Colonel General Mykhailo Koval, Head of the National Defense University of Ukraine, shared his military experience and emphasized the importance of supporting veterans. He noted that the war in Ukraine is extremely difficult, and it is important that those returning from the frontline feel cared for and supported by society. Koval emphasized the need to create a rehabilitation and reintegration system for the military that would take into account the physical, psychological and professional aspects of their recovery.

Dmytro Shatrovsky, Head of the Veterans Council at the Ministry of Veterans and a veteran of the Azov Regiment, and Taras Leliukh, Head of the Business Association of Defenders of Ukraine Kolovorot Areiv, raised important issues of doing business by war veterans. They drew attention to the difficulties that veterans face when trying to start their own business after returning from the front. The speakers emphasized that successful integration of veterans into the business environment requires not only financial support but also systematic assistance from the state, the financial sector, and NGOs. Leliukh also emphasized the need to facilitate access to financial products for veterans, including solving problems with credit histories.

At the Roundtable, Maria Kvitka, Managing Associate of Korn Ferry Ukraine, presented the results of a survey of employers on business support for veterans. This project was implemented in partnership with the National Bank of Ukraine. She noted that more and more companies are implementing programs to support veterans, both employees and entrepreneurs, ensuring social responsibility and creating conditions for professional adaptation. At the same time, she drew attention to the difficulties some companies face in integrating veterans into their teams, emphasizing the importance of long-term retraining and psychological support programs to facilitate the successful reintegration of veterans into the business environment.

Bank representatives shared practical examples of supporting veterans. They talked about launching specialized loan programs aimed at developing veteran entrepreneurship, as well as creating adapted financial products that take into account the needs of military personnel returning to civilian life. Banks are actively working to ensure barrier-free access to their services, including the implementation of inclusive solutions for people with disabilities. In addition, representatives of financial institutions emphasized the importance of social initiatives and corporate responsibility during the war aimed at supporting veterans and their families.

For example, Oksana Kutsokon, Head of Mass Business at Privatbank, presented a new initiative, the Business School for Defenders, which will provide veterans with the knowledge and tools to start their own business.

Sergiy Mamedov, Chairman of the Management Board of Globus Bank JSC and Vice President of AUB, in his speech focused on the bank's plans to expand lending programs for veterans in 2025. He noted that these initiatives are aimed at supporting veteran entrepreneurship by providing them with access to financing on favorable terms. Mamedov also emphasized the importance of creating specialized financial products for veterans to help them not only adapt to civilian life but also develop their own businesses, contributing to Ukraine's economic stability.

Sergiy Mamedov, Chairman of the Management Board of Globus Bank JSC and Vice President of AUB, in his speech focused on the bank's plans to expand lending programs for veterans in 2025. He noted that these initiatives are aimed at supporting veteran entrepreneurship by providing them with access to financing on favorable terms. Mamedov also emphasized the importance of creating specialized financial products for veterans to help them not only adapt to civilian life but also develop their own businesses, contributing to Ukraine's economic stability.

Oleksandr Voltornist, Head of Customer Experience Development at Idea Bank, presented financial products specially designed for veterans, including loyalty programs and loan solutions with facilitated terms.

In her speech, Yulia Chemeriska, Head of Real Estate Expert Support, Property Management and Maintenance Department, Raiffeisen Bank, spoke about the adaptation of bank branches for veterans, taking into account the needs of people with disabilities, providing barrier-free access to services

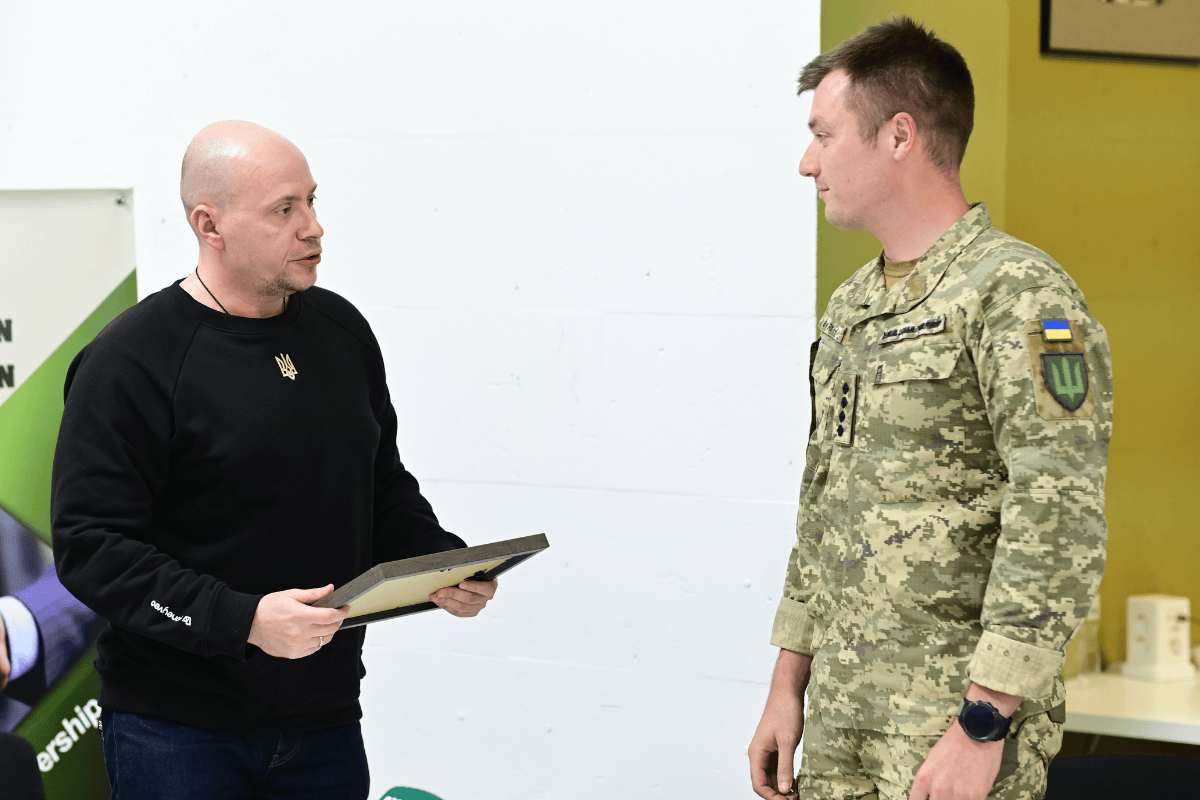

The Roundtable focused on the corporate social responsibility of financial institutions during the war. Sergiy Sinchenko, CEO of Maniveo and Chairman of the UBA Non-Bank Lending Committee, spoke about volunteer support programs for the Ukrainian Defense Forces, as well as non-bank financial products for veterans, including microloans to support their businesses. Sergiy Sinchenko also noted that the financial sector has been supporting the Ukrainian Defense Forces since the first days of the war and emphasized that the financial sector's support for veterans and active military personnel, as well as for the Armed Forces units, are parallel processes. At the end of his speech, the Maniveo CEO handed Oleksiy Khidko, an officer of the unmanned aerial systems unit, a certificate for an unmanned aerial vehicle that is already helping the military stop the enemy at the front.

The Association of Ukrainian Banks' roundtable discussion “Social Integration and Adaptation of Veterans: the Role of the Banking Sector” was an important event that demonstrated the financial sector's readiness to take an active part in the social integration and economic adaptation of veterans. Representatives of banks and non-banking institutions demonstrated a number of initiatives aimed at supporting veterans in financial and business aspects. The event resulted in an agreement to continue cooperation and create new products and programs for veterans to help them successfully return to civilian life, socialize, find a job or develop their own business.

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775