AUB News

AUB study: war has increased demand for microcredit in Ukraine

The Association of Ukrainian Banks together with the research company "Research.Uey" and experts of the Institute of Sociology of the National Academy of Sciences of Ukraine conducted a sociological study "Consumer microcredit in Ukraine during martial law", which focuses on microcredit trends among the population of Ukraine during the war. According to the data, almost half of microfinance users note an increase in the need for loans during a full-scale war, and 23% say that they applied for microloans for the first time because of military operations. The study also revealed that Ukrainians mainly take microloans for daily household needs.

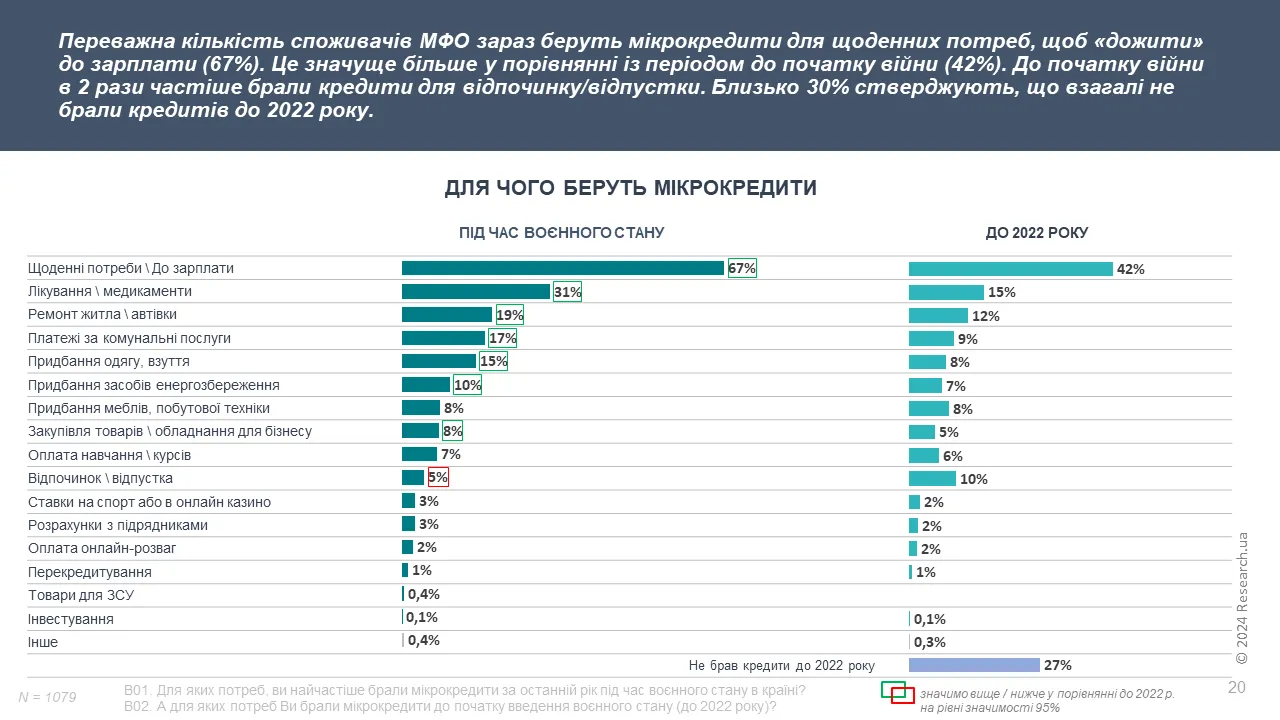

Microcredit remains a niche, but socially significant segment of the credit market, which plays an important role in meeting the urgent needs of citizens during the war. The study showed that the need for microcredit increased during the war state Almost half (48%) of users of microfinance services note an increased need for loans during martial law, which is significantly higher than the market average (31%). For 23% of respondents, the need for credit appeared for the first time precisely because of the war. The vast majority of respondents use microloans to cover their daily needs and point to the simplicity, speed and availability of these services compared to traditional banking products. The majority of respondents (67%) take out microloans to cover daily expenses and provide urgent expenses before salary.

The majority of users (62%) are satisfied with the level of service provided by microfinance fintech companies (hereinafter referred to as IFTC or MFI - microfinance organizations), although they believe that interest rates on microloans should be reduced. It is worth noting that the survey was conducted at the end of last year, before the reduction of the interest rate on microloans, which today, according to the current legislation, should not be more than 1% per day. A very small proportion of users apply for microloans at night (to 2%). And even among those who take out a loan at night, they mostly do it for ordinary daily needs. For example, buying medicine in an emergency, paying utilities or rent to avoid late fees, or small unexpected expenses that can't wait until the morning. This could include the need for emergency car repairs, late-night taxi fares, or even last-minute grocery or other essentials. The survey showed that "night microloans" are not evidence of reckless financial decisions, but rather reflect urgent needs that arise outside the usual working schedule of borrowers. Almost 90% say that neither the time of day nor the days of the week when applying for a loan do not matter. changed during martial law. 60% have 1-3 active microcredits and 70% use 1-3 IFTC at the same time. The main reason for using several loans is a lack of money (61%), that is, the amount of one loan is most likely not enough to cover all necessary expenses. 30% of users do not see any risks in receiving microloans.

Commenting on the results of the survey, the president of AUB Andriy Dubas said that he does not expect significant competition from MFIs in the market of bank loans due to excellent business models and the specifics of loan products. However, the president of AUB noted that financial companies, in particular microfinance organizations, can compete with the country's small banks in the technology of services, which in turn will stimulate the latter to develop faster in this direction.

"This study highlights the social significance, and in some cases, the critically necessary role of microcredit in Ukraine during martial law, which provides temporary support to those in financial distress. At the same time, the survey points to the need to provide more affordable financial products for vulnerable segments of the population. The study also proves that the vast majority of companies operating in the microfinance market fully adhere to the concept of responsible lending implemented by the National Bank of Ukraine," said Andrii Dubas, President of the Association of Ukrainian Banks.

You can read more about the research at the link - "Consumer microcredit in Ukraine under time of martial law"

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775