Financial sector news

Overview of International Markets and Finance as of October 1, 2025

- Source: IAC AUB

Politics

The U.S. Congress missed the midnight budget funding deadline, triggering the first government shutdown in nearly seven years. Government operations have been suspended, except for essential functions.

The shutdown may be prolonged due to a deadlock over healthcare subsidies, as the White House Budget Office has instructed agencies to begin implementing their shutdown contingency plans.

This will disrupt the work of hundreds of thousands of Americans, disorganize many public services, and could have economic consequences, including a potential rise in unemployment and delays in key economic data.

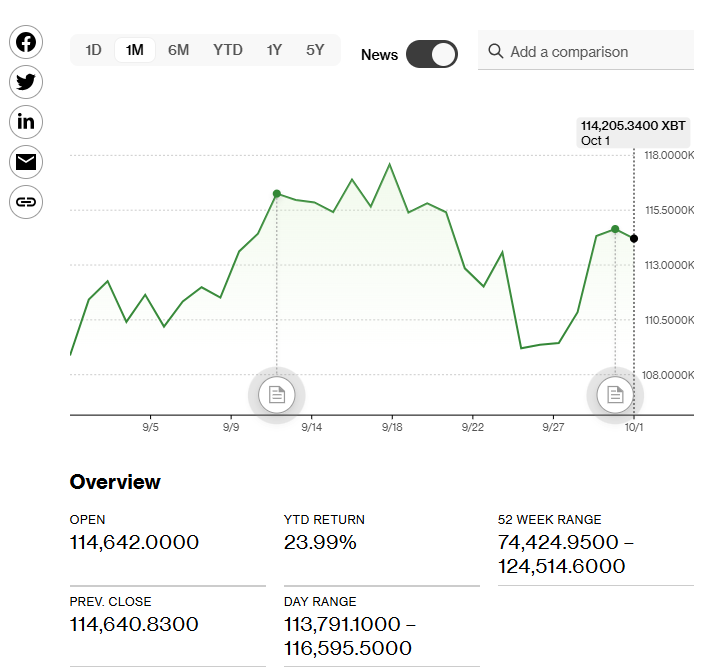

Bitcoin

As of the morning of October 1, Bitcoin surged to $116,300.

Monthly trend:

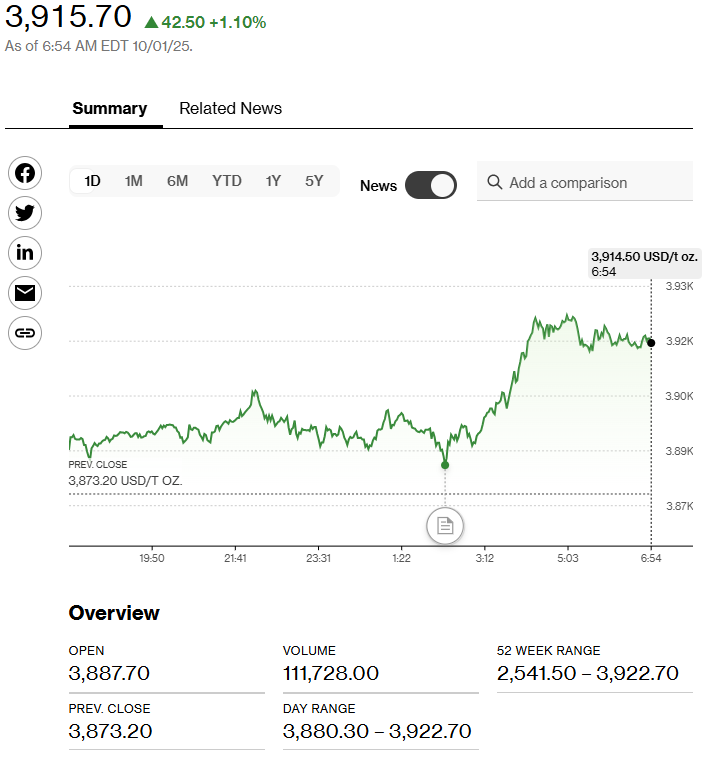

Gold

The price of gold has also risen, reaching historic highs. This year it has increased by more than 48%, putting it on track for the biggest annual gain since 1979. Such dynamics are driven by active purchases from central banks and the growing inflows into gold-backed exchange-traded funds (ETFs).

Daily trend:

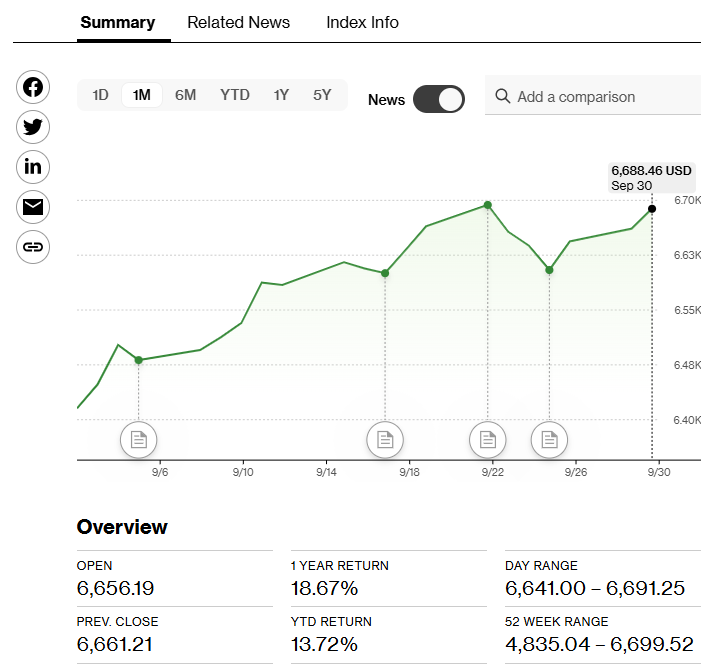

Stocks

Despite positive momentum in September, S&P 500 futures fell 0.6% on October 1 as traders reduced risk following the benchmark’s strongest September in 15 years amid the government shutdown.

China’s MSCI index rose nearly 9% in September, marking the fifth consecutive month of gains. Since hitting a low in April, the index has added about 40%.

S&P 500 trend for September:

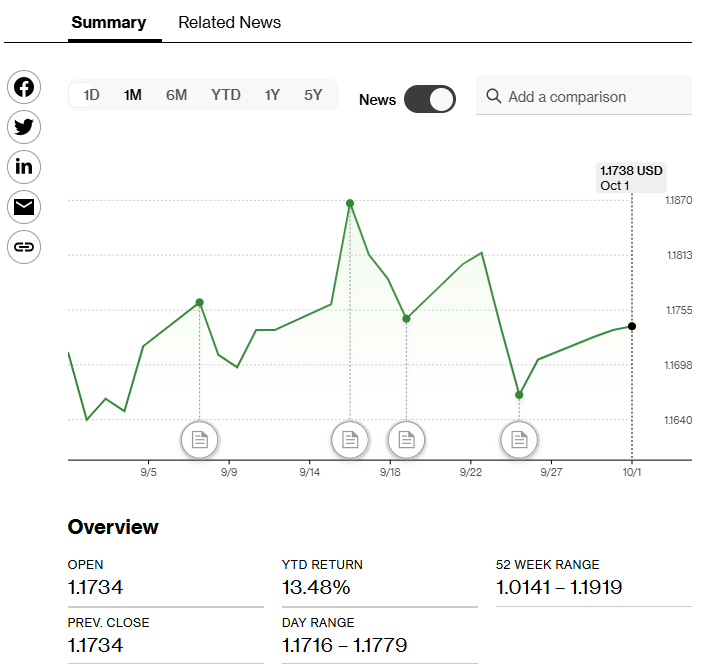

Currency

Experts expect a decline in the US dollar, but as of the morning of October 1, it remains stable.

Banks

The European Central Bank (ECB) has kept key rates unchanged since June 11:

Overnight deposit rate — 2.0%

One-week lending rate — 2.15%

Overnight lending rate — 2.4%

On September 30 in Helsinki, ECB President Christine Lagarde spoke at a monetary conference, noting that U.S. tariffs are estimated to cause losses of up to 1% of the EU’s GDP. At the same time, these losses will be partially offset by increased investment and stronger trade with Mexico and other American countries.

The ECB rate corresponds to the actual inflation level of 2%, which is the target. Risks will remain under control in the future amid significant global uncertainty. The full text of the speech is published on the ECB website.

Statistics on the largest and local banks in the Eurozone:

| indicator | largest banks |

local banks |

||

| Q2 2024 | Q2 2025 | Q1 2024 | Q1 2025 | |

| Number of banks, units | 110 | 113 | 1,919 | 1,851 |

| Assets, € billion | 26,608.53 | 27,749.65 | 4,843.45 | 4,791.81 |

| Liabilities | 24,816.61 | 25,833.21 | 4,333.95 | 4,268.58 |

| Capital | 1,791.91 | 1,916.45 | 509.50 | 523.23 |

| Operating income | 308,582.73 | 320,306.05 | 35,642.54 | 33,769.47 |

| Margin | 1.61% | 1.51% | 2.03% | 1.90% |

| Costs to income | 54.24% | 54.15% | 59.22% | 61.76% |

| Cost of risk | 0.46% | 0.46% | n.a.5) | n.a.5) |

| RОЕ | 10.11% | 10.11% | 9.91% | 6.91% |

| CET 1 ratio | 15.81% | 16.12% | 17.75% | 17.86% |

| Tier 1 ratio | 17.21% | 17.60% | 17.94% | 18.01% |

| Total capital ratio CAR | 19.90% | 20.24% | 19.03% | 19.08% |

| Leverage | 5.77% | 5.90% | 9.45% | 9.96% |

| NPL | 2.30% | 2.22% | 2.47% | 2.70% |

| Stage 2 impaired loans | 9.45% | 9.59% | n.a.5) | n.a.5) |

| Loan-to-deposit ratio | 102.11% | 102.16% | 89.85% | 87.51% |

| Net stable funding ratio NSFR | 127.32% | 126.74% | 132.21% | 133.03% |

| Liquidity coverage ratio LCR | 159.47% | 157.84% | 217.17% | 216.36% |

Sincerely,

Information and Analytical Center of the Association of Ukrainian Banks

Have questions?

Contact us:

380 (44) 516-8775

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775