Financial sector news

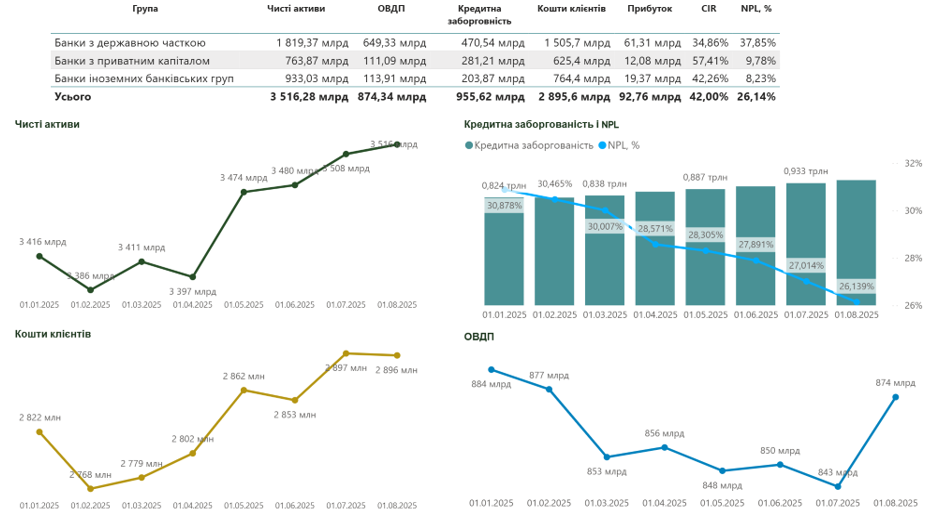

Key indicators of the Ukrainian banking system as of August 1, 2025

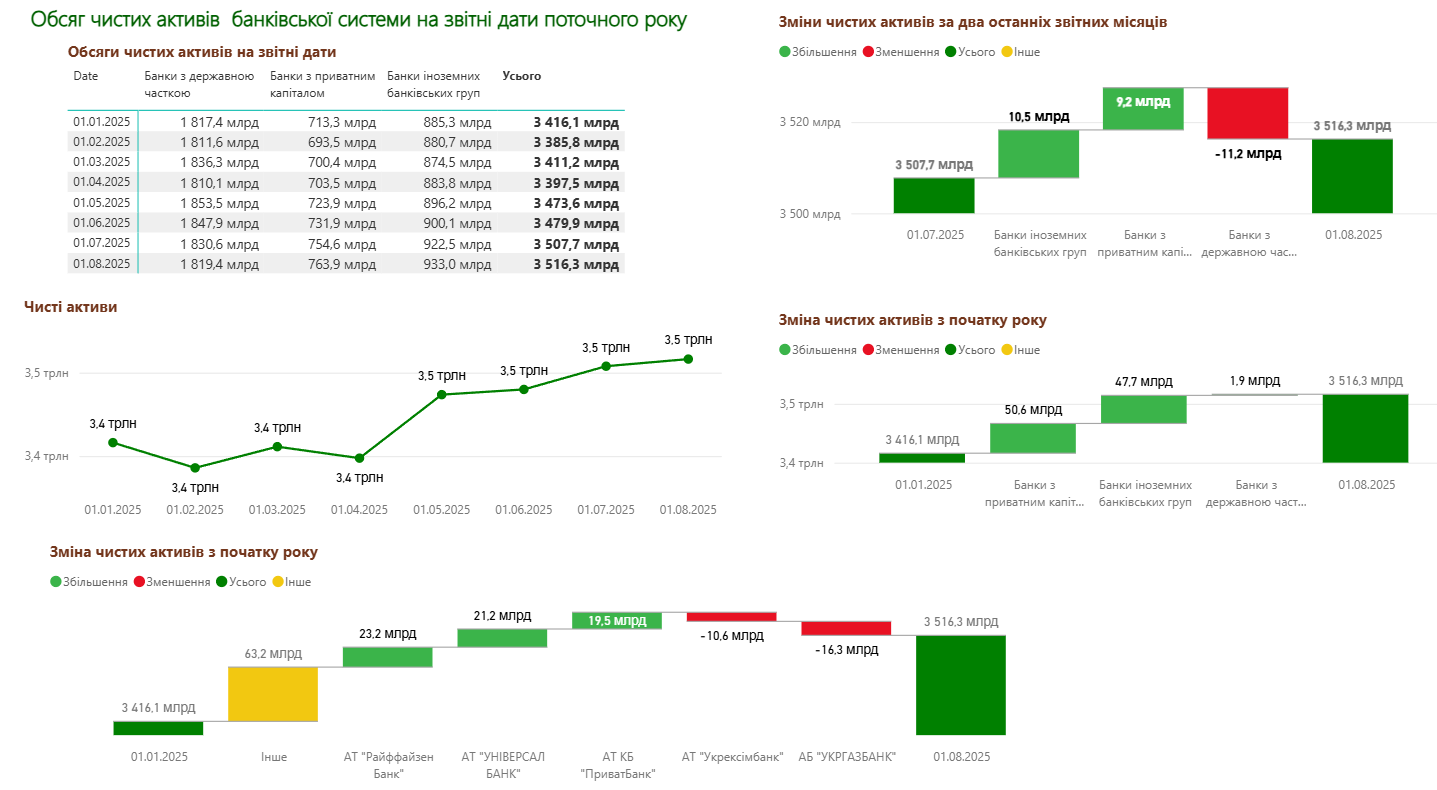

The net assets of the banking system have shown positive dynamics since the beginning of this year, growing by almost UAH 100.2 billion.

The highest growth rate was achieved by privately owned banks (by UAH 50.6 billion). At the same time, over the last reporting month, the volume of net assets in banks with state ownership decreased by UAH 11.2 billion.

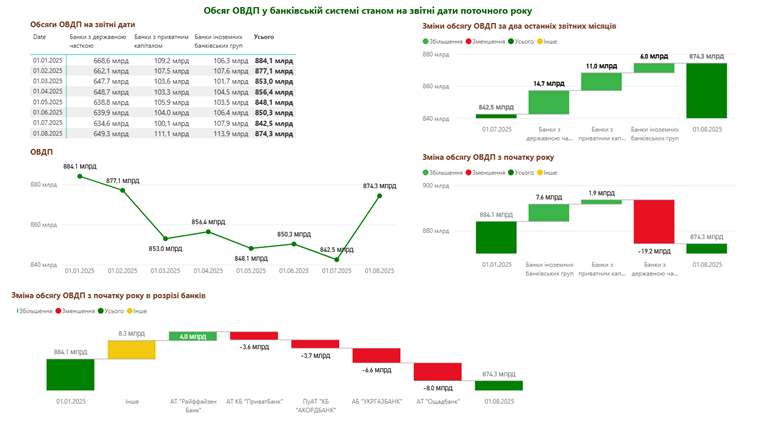

The volume of government bonds has shown slight volatility since the beginning of the year, with the total amount decreasing by almost UAH 9.8 billion. The largest decrease occurred in banks with state participation — by UAH 19.2 billion. As of August 1, 2025, the majority of government bonds (74.3%) are concentrated in banks with state participation.

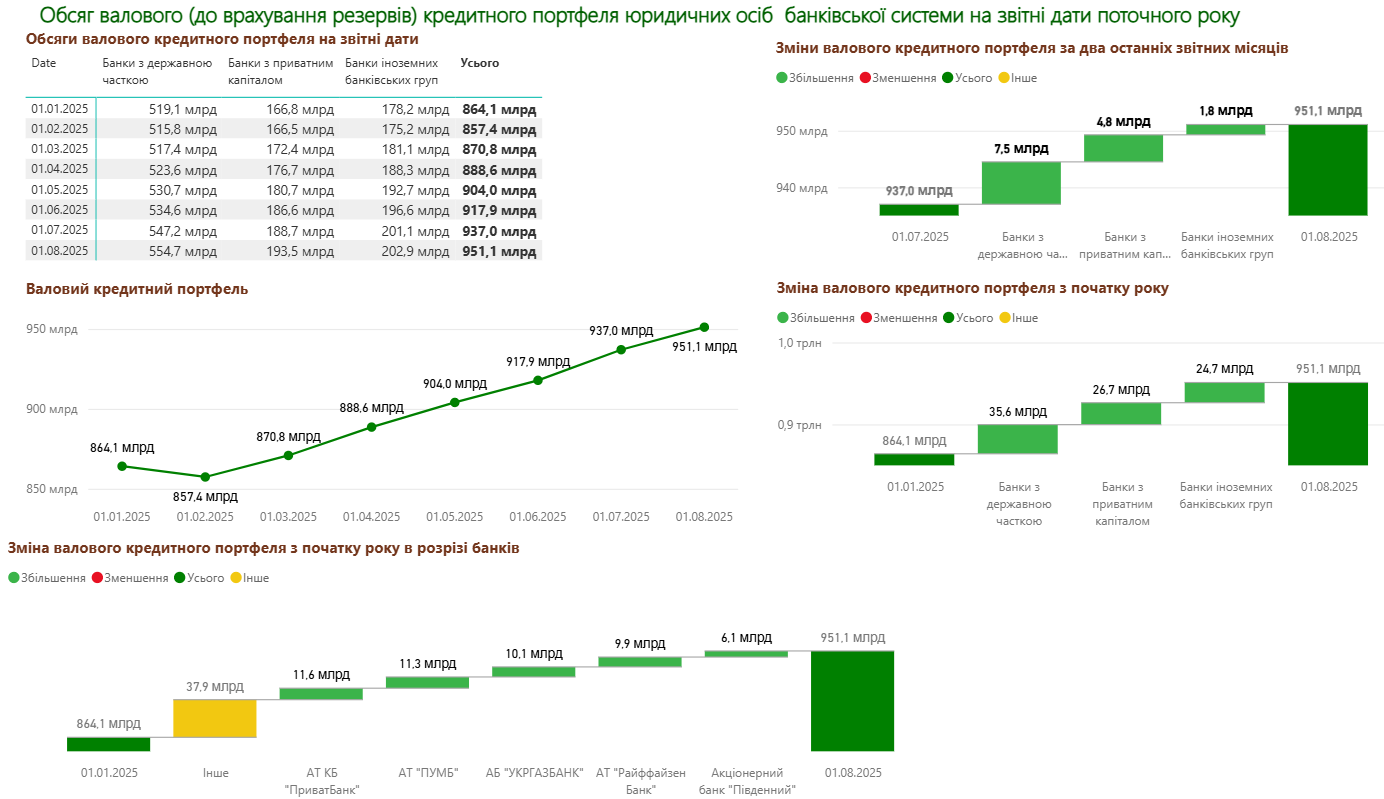

Since the beginning of this year, i.e. over seven months, lending to the real sector of the economy has grown by almost 10% (or UAH 87.0 billion). The largest increase in the loan portfolio of legal entities was provided by banks with state participation — by UAH 35.6 billion. At the same time, banks with private capital demonstrated the highest growth rate of the loan portfolio — 1.16 times.

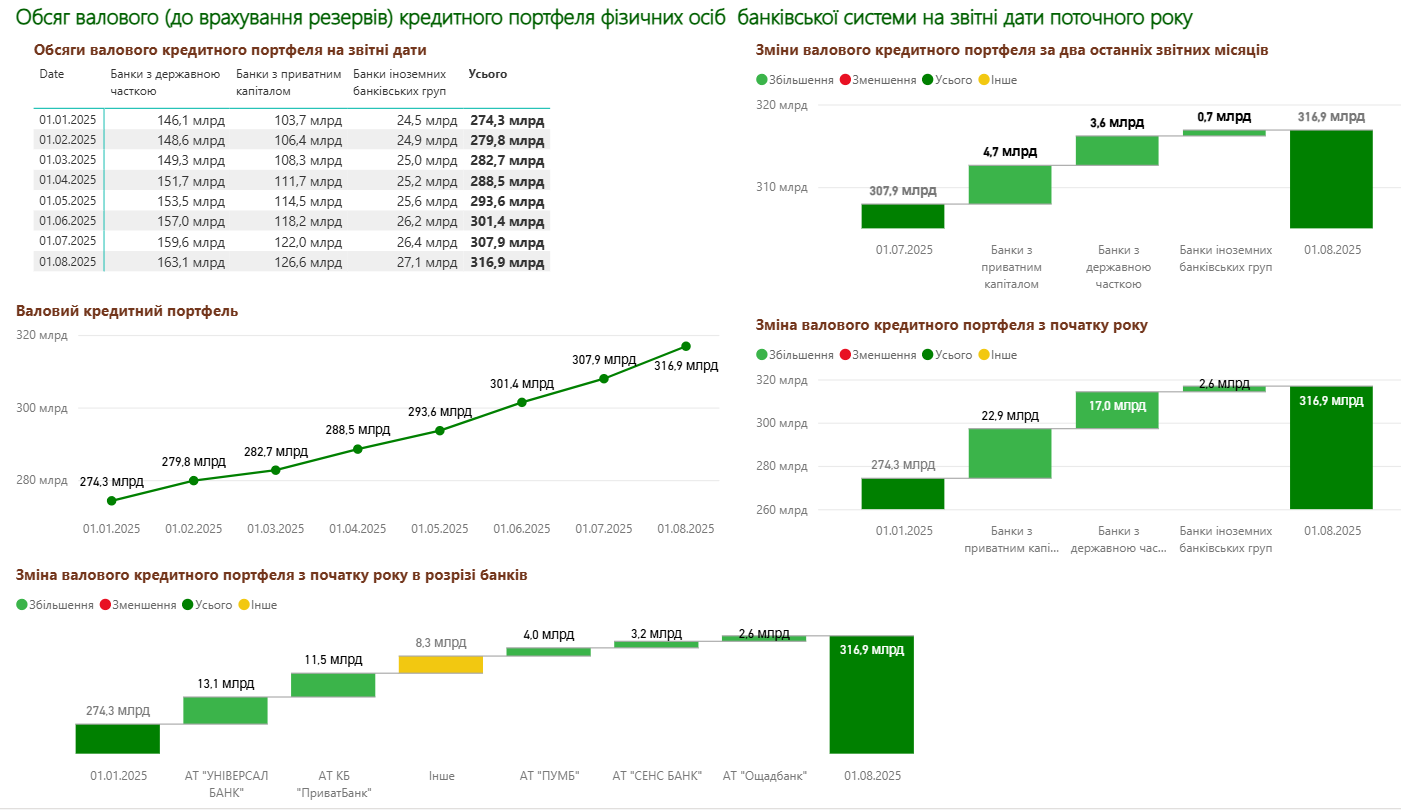

Since the beginning of the year, the volume of the retail loan portfolio has increased 1.15 times. Private banks remain the leaders in terms of growth in this portfolio, with an increase of UAH 22.9 billion. Also, as of August 1, 2025, the largest share of the retail loan portfolio is concentrated in state-owned banks, accounting for 51.5% of the total deposit portfolio.

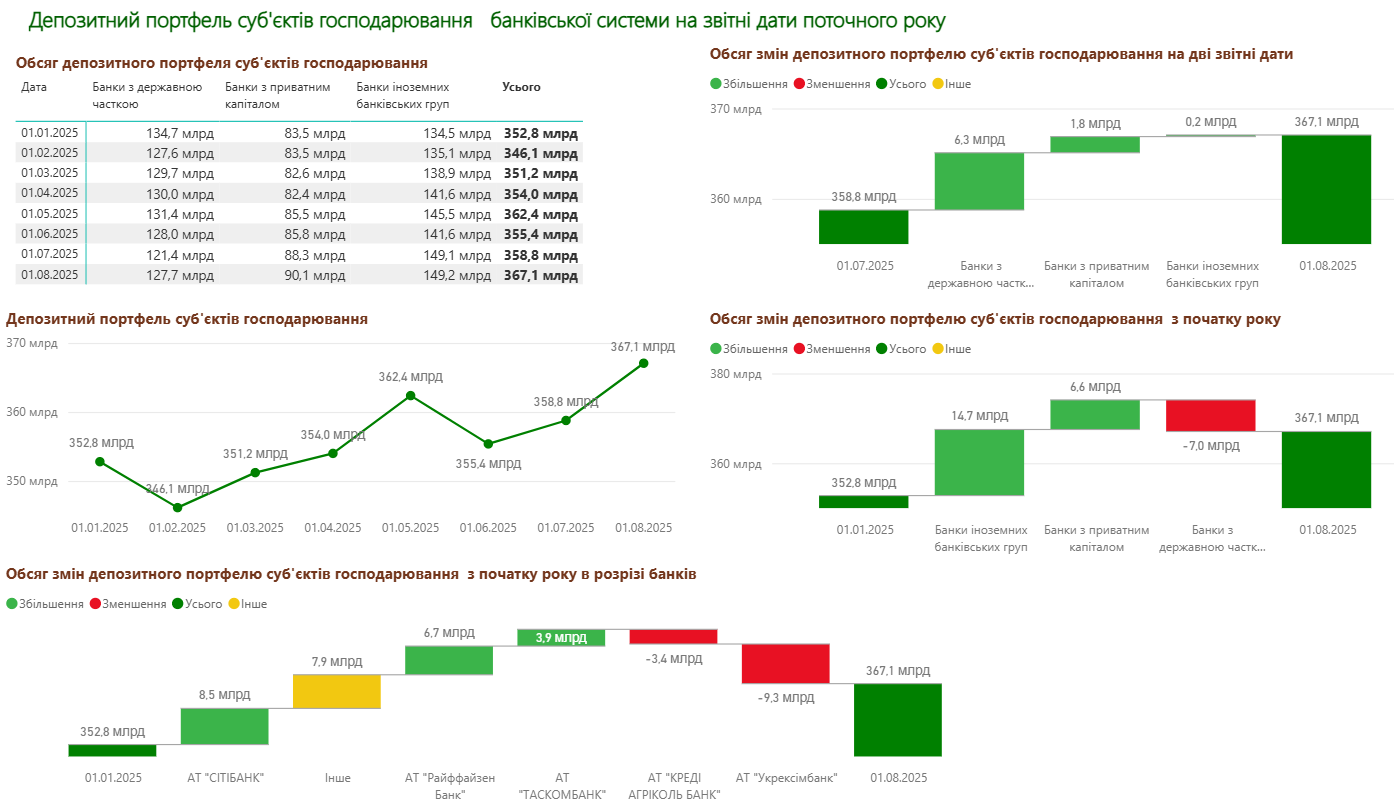

The deposit portfolio of business entities shows positive dynamics: since the beginning of the year, its volume has increased by UAH 14.3 billion. Banks belonging to foreign banking groups became the leaders in terms of deposit portfolio growth (UAH 17.7 billion), while banks with state participation lost UAH 7.0 billion in deposits this year.

The deposit portfolio of individuals shows stable positive dynamics—since the beginning of this year, it has grown by 23.7% and as of August 1, 2025, amounts to UAH 440.4 billion. The most significant growth during this period was provided by privately owned banks — UAH 14.4 billion. At the same time, the largest share of the deposit portfolio belongs to state-owned banks — 55.9% of the total volume as of August 1, 2025.

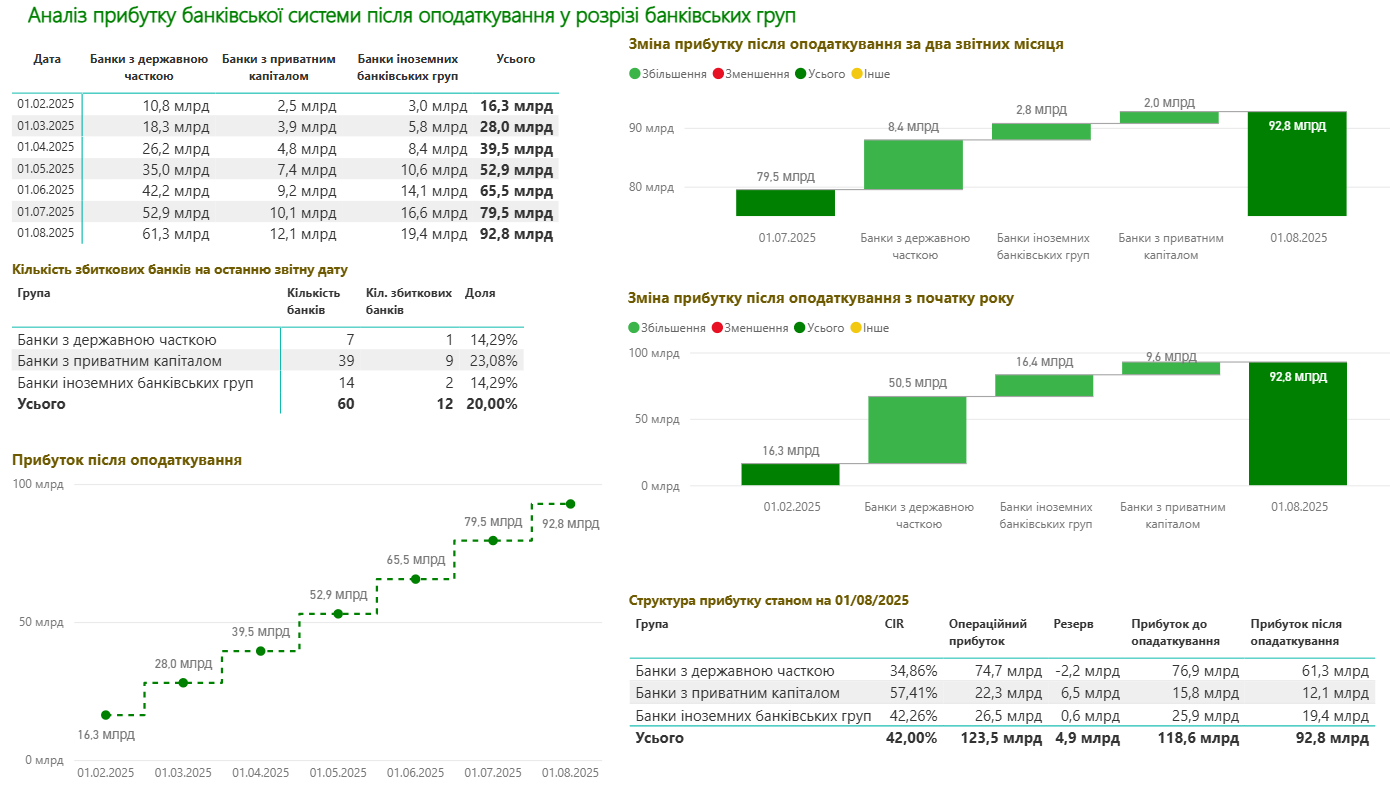

As of August 1, 2025, the banking system received a net profit of UAH 92.8 billion.

The largest amount of profit was generated by banks with state ownership. The share of net profit in banks with state ownership is UAH 61.3 billion (or 66.0% of the total).

In general, the CIR (Cost-to-Income Ratio) indicator shows the high efficiency of bank management.

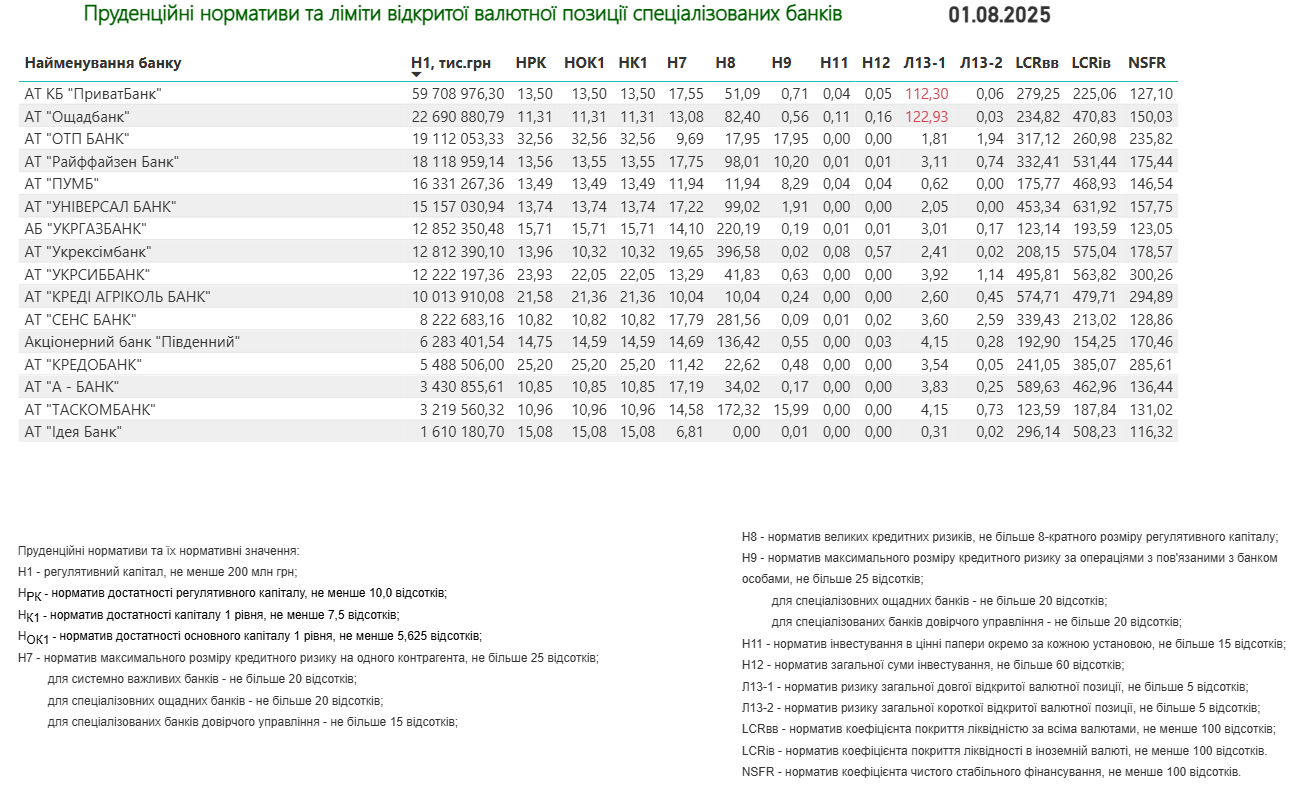

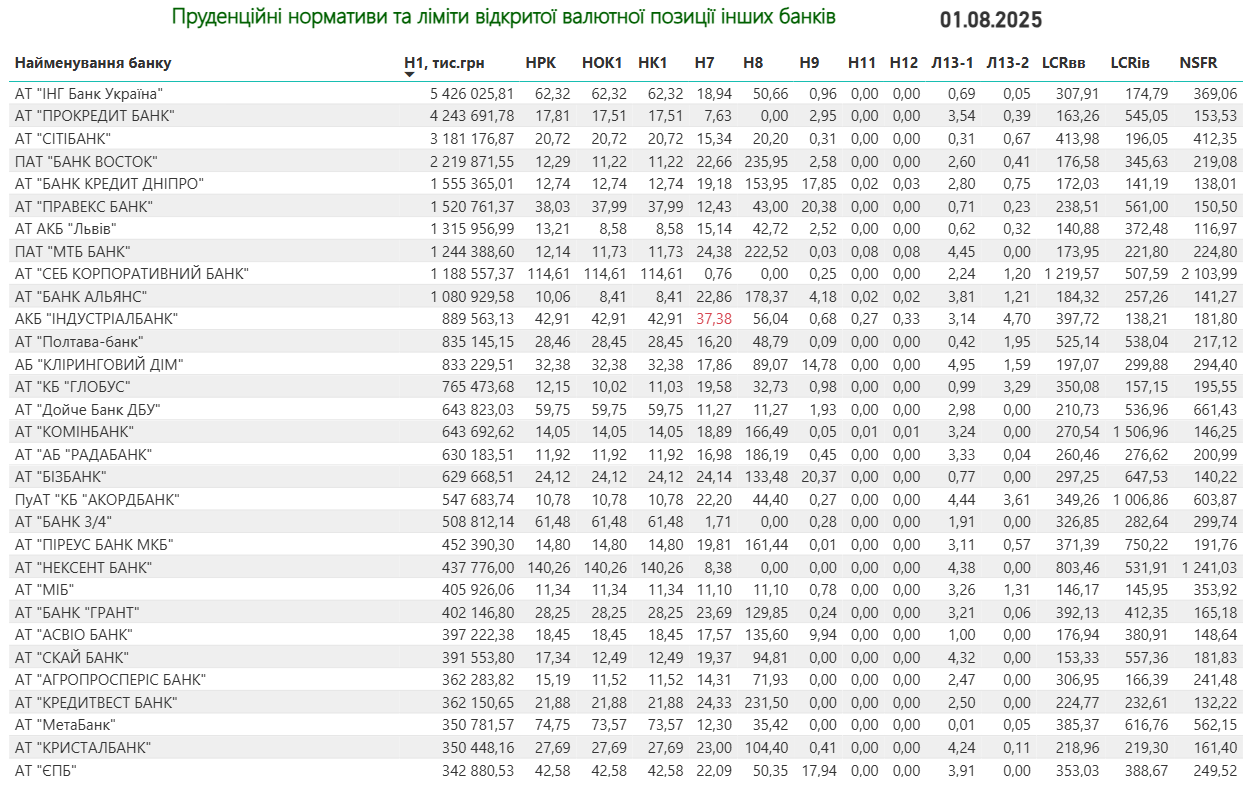

As of August 1, 2025, some banks exceed the NBU's prudential supervision regulatory values:

L13-1 (regulatory value for the risk of total long open currency position, no more than 5 percent) – JSC CB PrivatBank, JSC Oschadbank.

N7 (maximum credit risk per counterparty, no more than 25%): Industrialbank JSC, RVS Bank JSC

H1 (regulatory capital, not less than UAH 200 million): JSC BTA Bank, JSC Motor Bank, JSC First Investment Bank, JSC RVS Bank

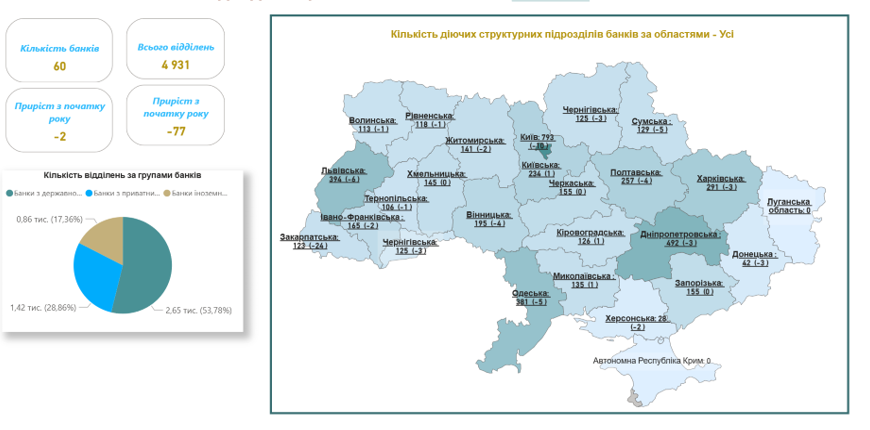

As of July 1, 2025, there are 60 banks operating in Ukraine. The total number of structural units is 4,931, of which banks with state ownership have 2,650 branches (53.8%), private banks have 1,420 (28.8%), and institutions belonging to foreign groups have 860 (17.4%).

The largest number of branches is concentrated in Kyiv (793), Dnipropetrovsk region (492), and Lviv region (394).

For reference: the NBU updates the number of structural units once a quarter.

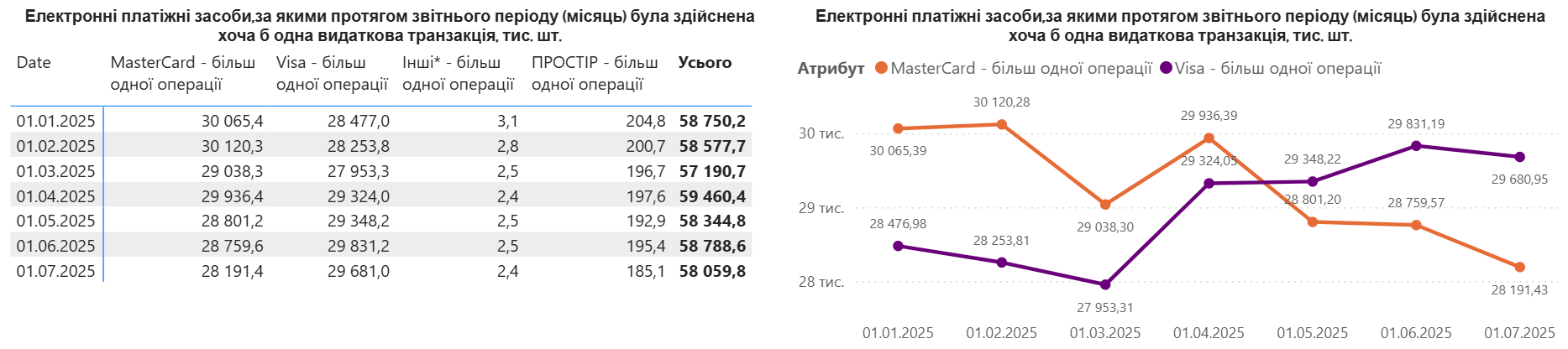

Data on the number of electronic payment instruments for which at least one expenditure transaction was made during the reporting period (June),

broken down by region

The number of electronic payment instruments used for at least one expenditure transaction during the reporting period (June) is 58,059.8 thousand, including in Kyiv (15,914.4 thousand units), Dnipropetrovsk (9,265.6 thousand units), and Lviv regions (3,014.2 thousand units).

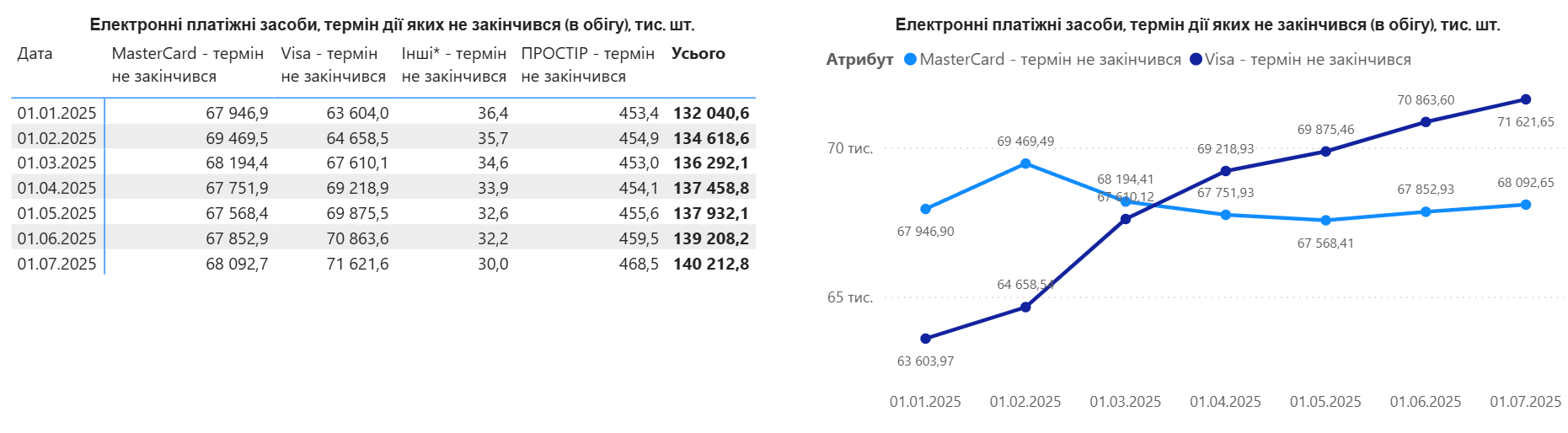

Data on the number of electronic payment instruments issued by Ukrainian issuers by payment system (data for the reporting period / as of)

As of July 1, 2025, the total number of electronic payment instruments that have not expired (in circulation) is 140,212,800. The total number of payment instruments for which at least one expenditure transaction was made during June is 58,059,800.

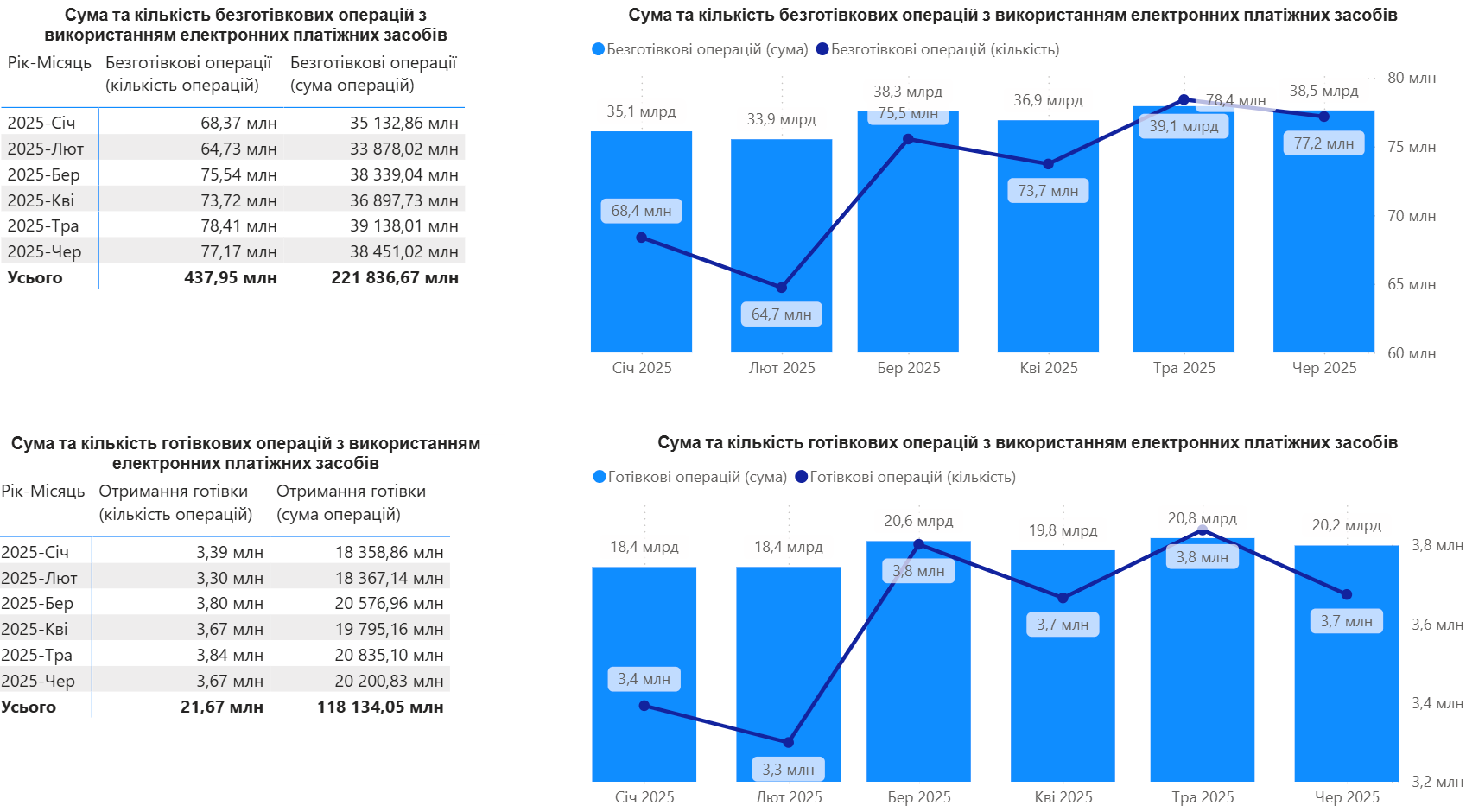

Amount and number of transactions using electronic payment instruments

issued by Ukrainian issuers

Since the beginning of the year, the volume of non-cash and cash transactions amounted to UAH 339,970.7 million, with 495.62 million transactions carried out.

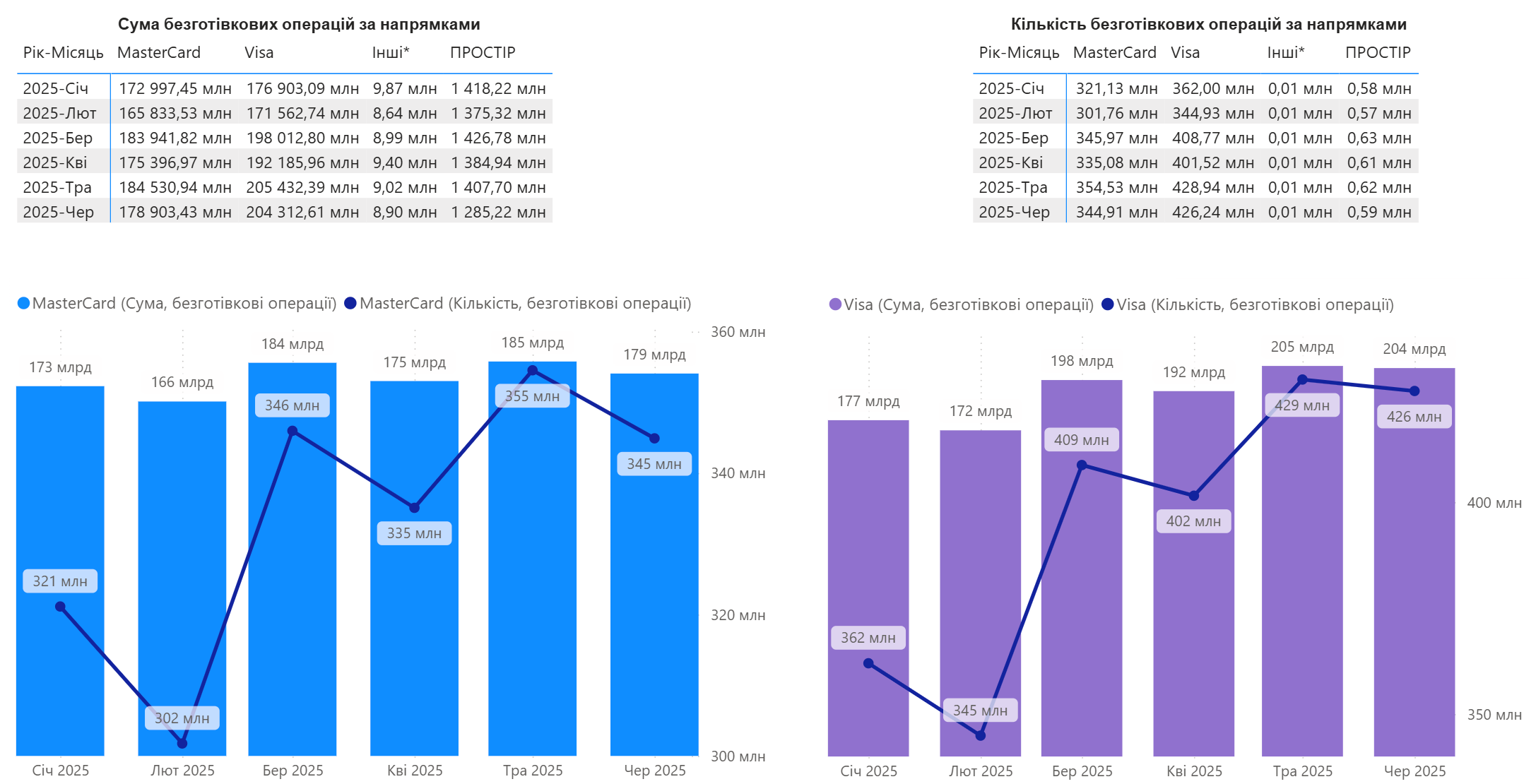

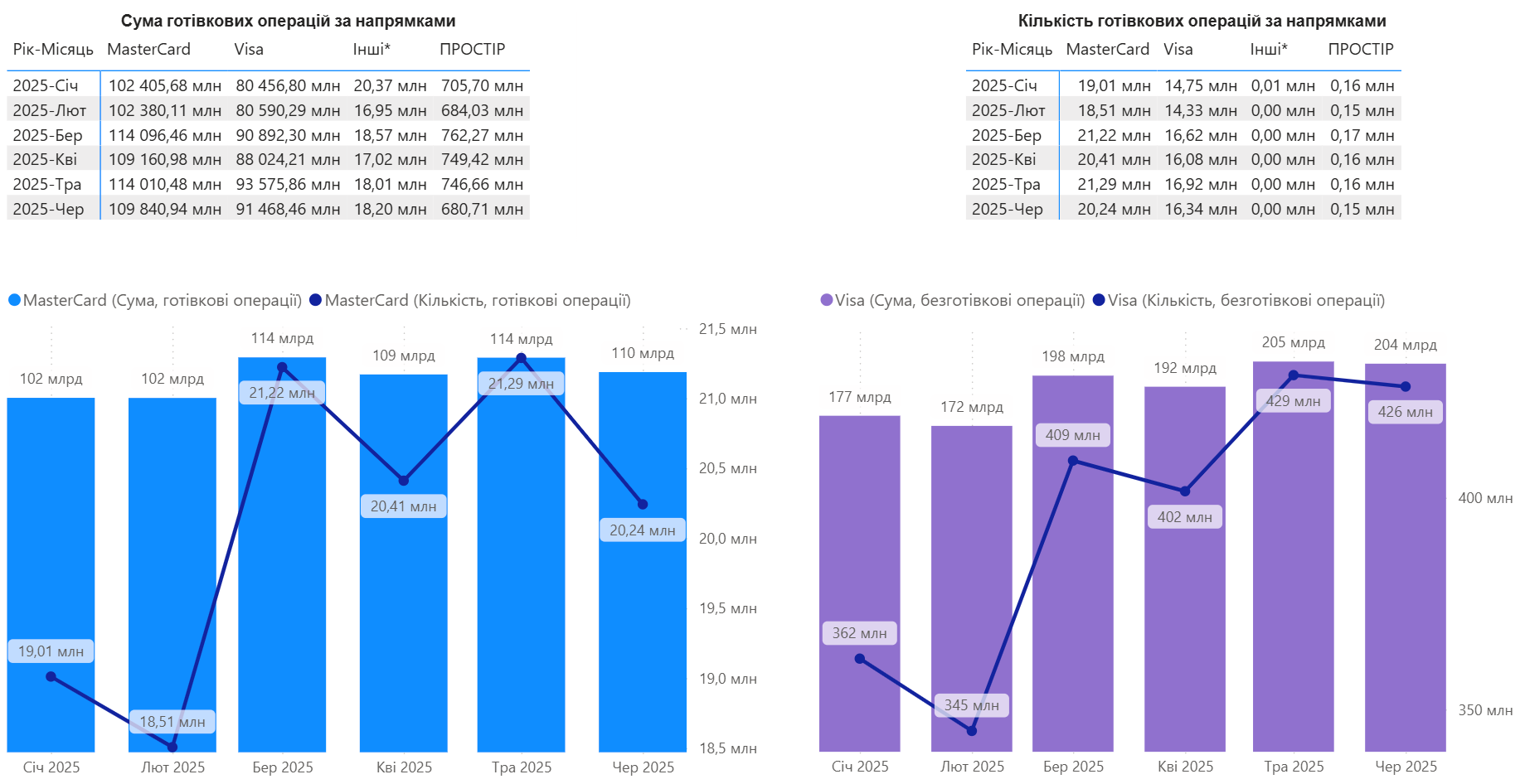

MasterCard and Visa payment instruments are the most actively used on the market. The total volume of transactions under these systems accounts for 99.5%: MasterCard's share is 50.3%, and Visa's is 49.2%.

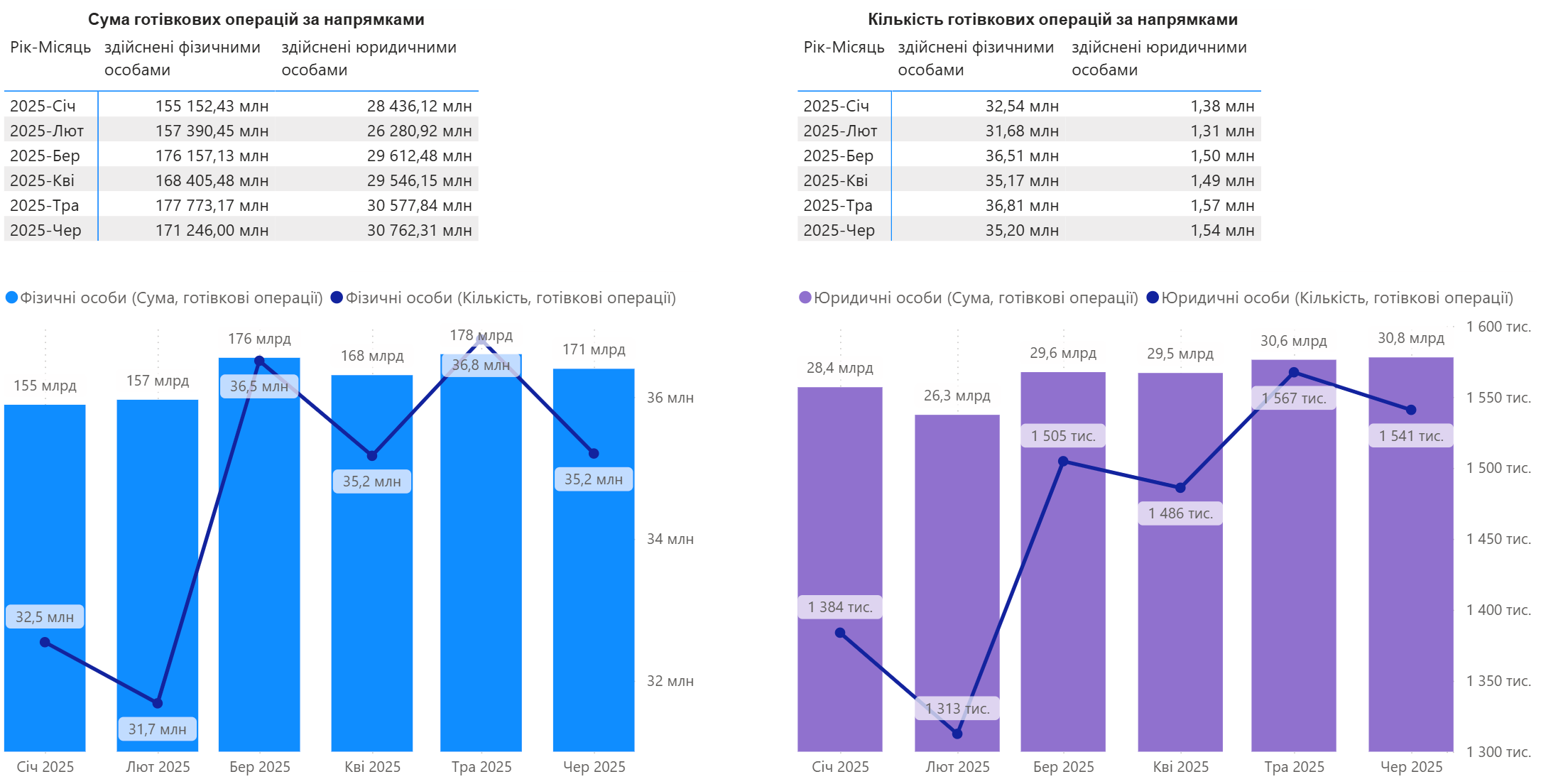

- in terms of individuals and legal entities for cash transactions

Since the beginning of 2025, the share of cash transactions by individuals using payment instruments has accounted for 85.2% of the total volume of transactions carried out by legal entities and individuals.

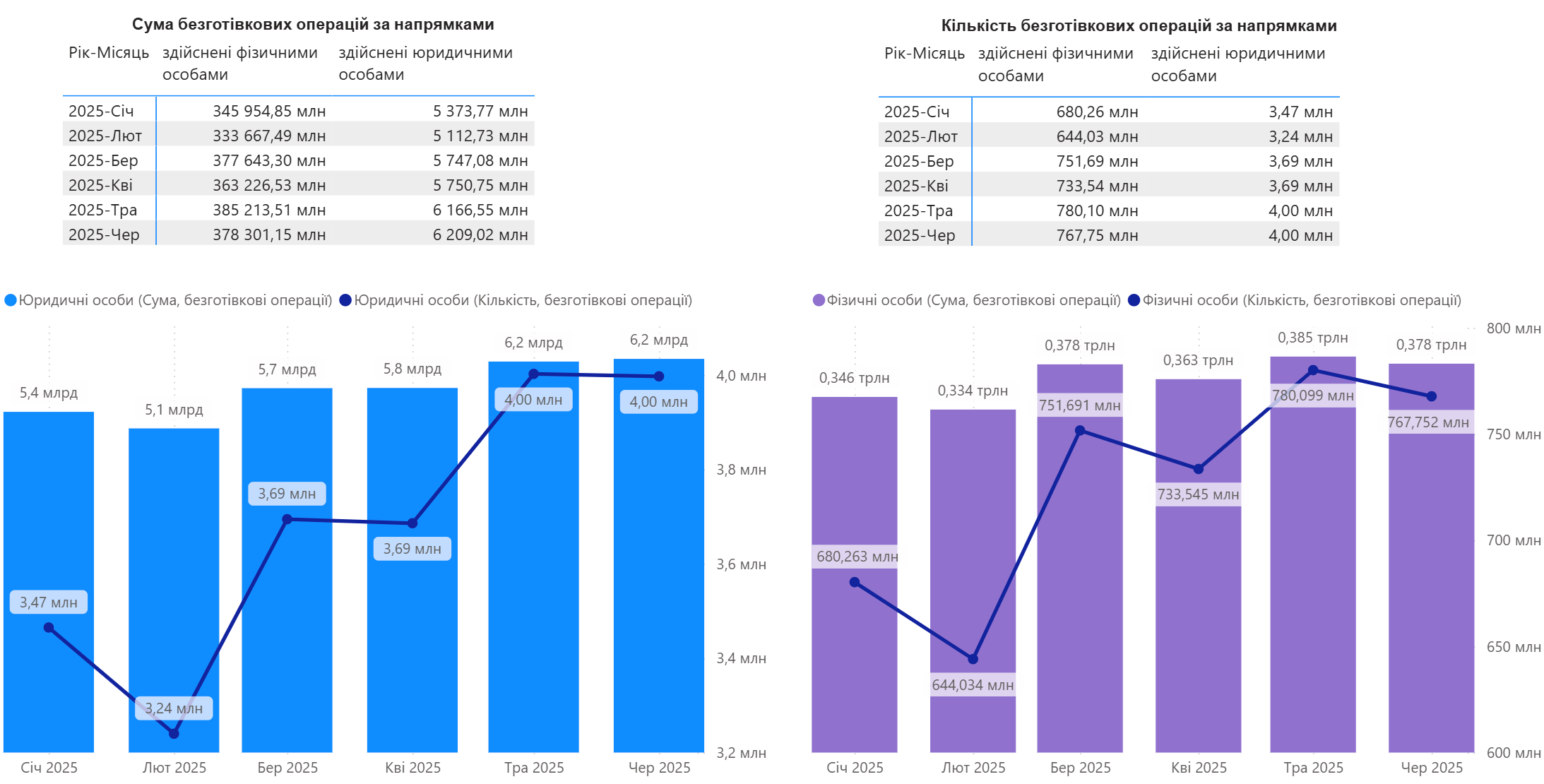

- broken down by individuals and legal entities for non-cash transactions

Since the beginning of 2025, individuals have carried out non-cash transactions worth UAH 2,184.0 billion, which accounts for 98.5% of the total volume of transactions by individuals and legal entities.

Sincerely,

Information and Analytical Center of the Association of Ukrainian Banks

Have questions?

Contact us:

380 (44) 516-8775

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775