Financial sector news

Ratings of Ukrainian banks: who moved up

- Source: IAC AUB

Since the beginning of 2025, Ukrainian banks have shown noticeable changes in their ratings.

As of August 1, some institutions have significantly improved their positions in key indicators, from net assets to lending and deposit volumes.

Let's take a closer look at each category:

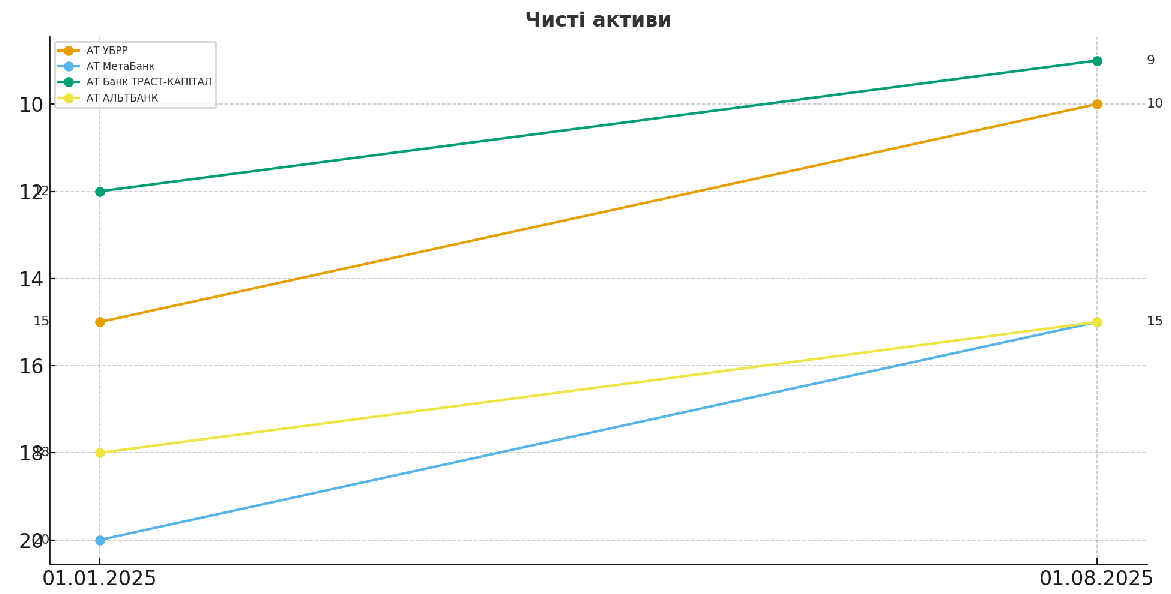

Net assets

- JSC UBRR – from 15th → to 10th (+5)

- MetaBank JSC – from 20th → to 15th (+5)

- TRUST-CAPITAL Bank JSC – from 12th → to 9th (+3)

- ALTBANK JSC – from 18th → to 15th (+3)

The chart shows the shift in banks' rankings based on net assets.

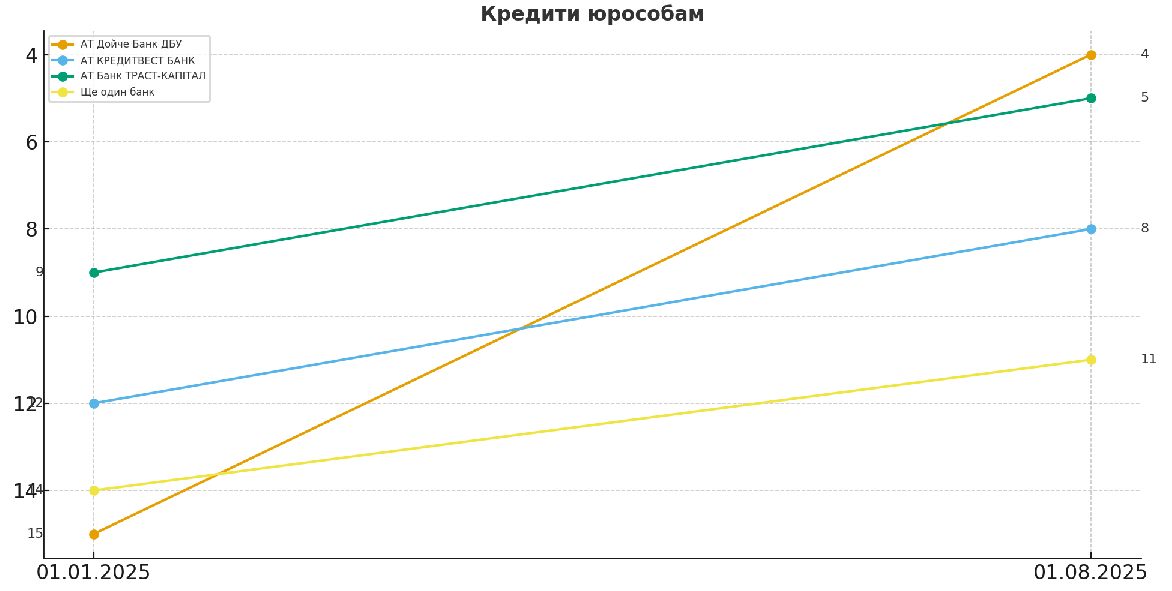

Loans to legal entities

- Deutsche Bank DBU – from 15th → to 4th (+11)

- JSC CREDITWEST BANK – from 12th → to 8th (+4)

- JSC Bank TRUST-CAPITAL – from 9th → to 5th (+4)

- ... (another bank with an increase of +3/+4)

The biggest jump was made by Deutsche Bank DBU, which entered the top 5 business lenders.

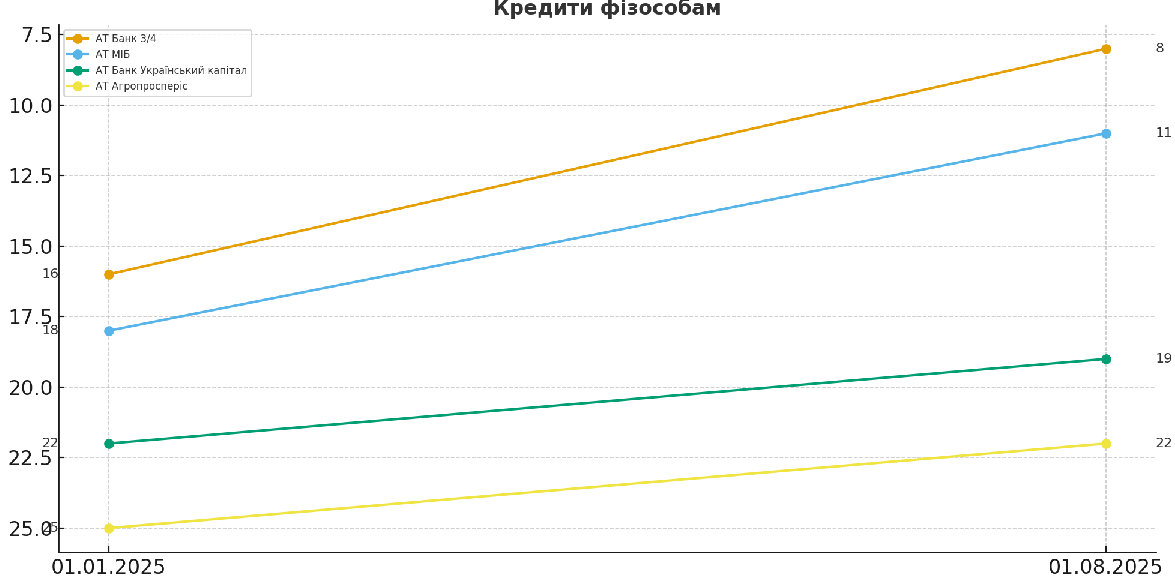

Loans to individuals

- AT Bank 3/4 – from 16th → to 8th (+8)

- AT MIB – from 18th → to 11th (+7)

- JSC Bank Ukrainian Capital – from 22nd → to 19th (+3)

- JSC Agropromsperis – from 25th → to 22nd (+3)

Growing demand for retail lending has lifted several banks in the rankings.

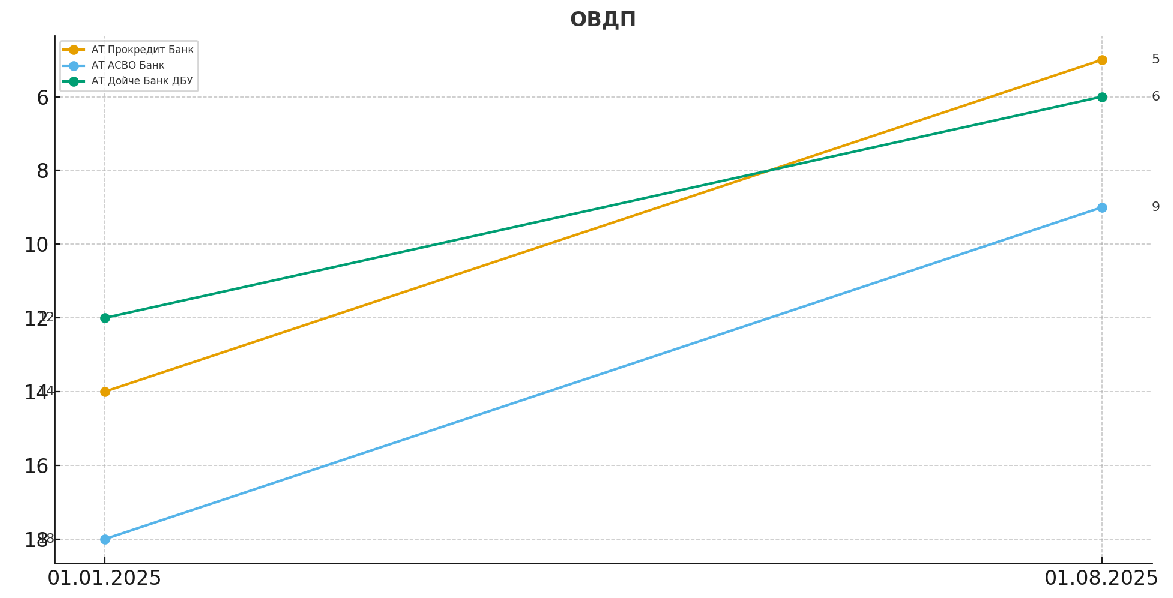

OVDP

- Procredit Bank JSC – from 14th → to 5th (+9)

- ASVO Bank JSC – from 18th → to 9th (+9)

- Deutsche Bank DBU JSC – from 12th → to 6th (+6)

Active work with government securities has significantly changed the balance of power.

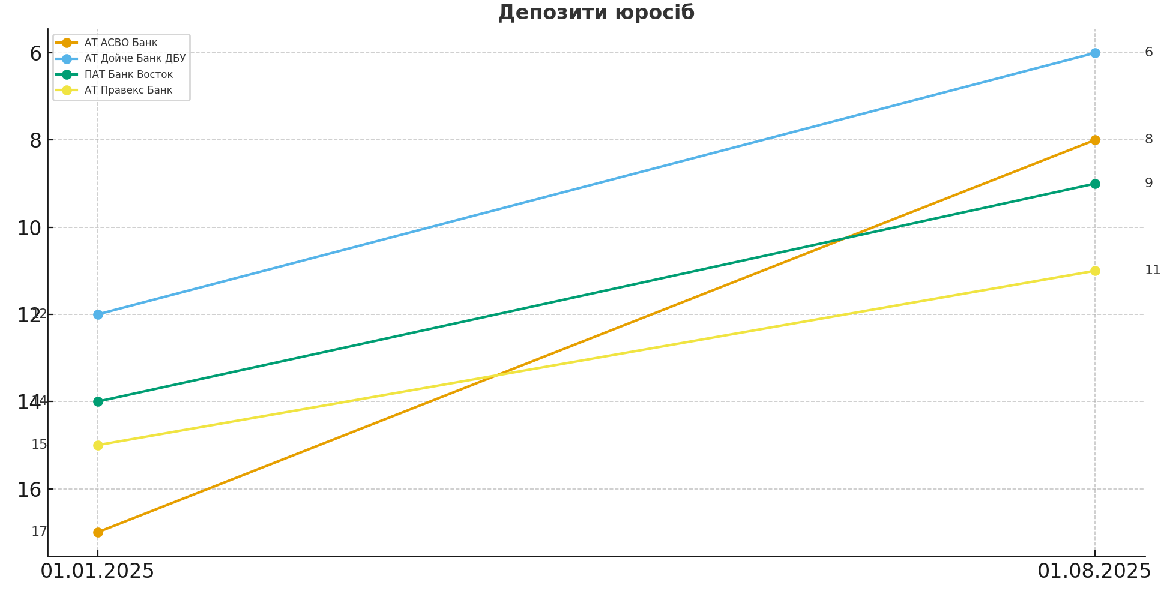

Deposits of legal entities

- ASVO Bank JSC – from 17th → to 8th (+9)

- Deutsche Bank DBU JSC – from 12th → to 6th (+6)

- Bank Vostok PJSC – from 14th → to 9th (+5)

- JSC Pravex Bank – from 15th → to 11th (+4)

Businesses have become more active in placing funds in a number of mid-tier banks.

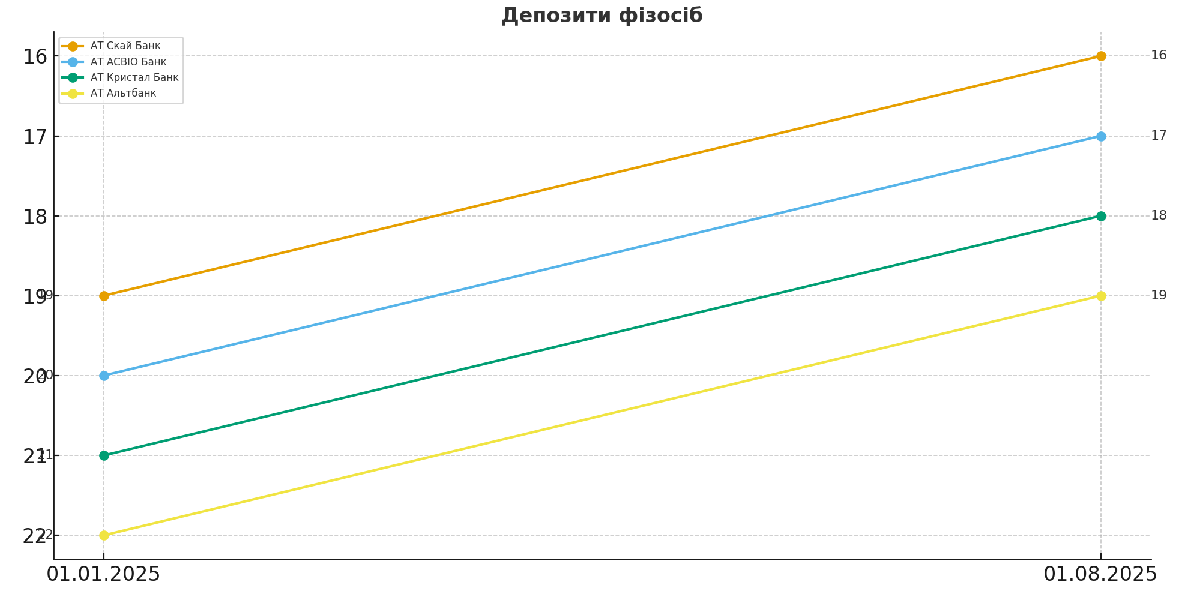

Deposits of individuals

- JSC Sky Bank - from the 19th → to the 16th (+3)

- JSC ASVIO Bank - from the 20th → to the 17th (+3)

- Crystal Bank JSC - from the 21st → to the 18th (+3)

- JSC Altbank - from the 22nd → to the 19th (+3)

In July, small banks actively attracted deposits from the population.

2025 was a year of significant changes in banking ratings.

Particularly notable were increases in business lending and work with government bonds.

Medium and small banks continue to grow their market presence, confirming their role as important players in the financial system.

Sincerely,

Information and Analytical Center of the Association of Ukrainian Banks

Have questions?

Contact us:

380 (44) 516-8775

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775