Financial sector news

Virtual assets: a new stage of regulation and taxation in Ukraine

- Source: IAC AUB

On September 3, the Verkhovna Rada of Ukraine adopted in the first reading a draft law on regulating the circulation of virtual assets. The document covers two key areas:

- amendments to the Tax Code of Ukraine;

- transformation of the current law “On Virtual Assets” into the law “On Virtual Asset Markets” with corresponding amendments to other legislative acts.

Tax innovations

Tax rates: 5% + 5% military tax based on 2026 results, and 18% + 5% thereafter.

Tax base: only the actual financial result from the sale or disposal of virtual assets.

Features: for individuals, asset revaluation is not a basis for taxation; for legal entities under IFRS, it must be reflected.

Restrictions: the simplified taxation system does not allow transactions with virtual assets.

Control: reporting and penalties are provided for service providers involved in the circulation of virtual assets.

Law “On Virtual Asset Markets”

Defines new categories of tokens:

- tokens pegged to assets;

- e-money tokens;

- other tokens (as determined by the regulator).

Unifies the definition of a virtual asset as a digital thing that can certify property rights.

Provides for conflicts with the Tax Code due to different approaches to definitions.

Challenges and prospects

Additional revenues: the potential for the budget is estimated at $10 billion.

The role of banks: the opportunity to become key intermediaries in the legal circulation of cryptocurrencies and tax administration.

Risks: capital flight into cryptocurrencies, pressure on the currency market, unresolved issue of foreign investment.

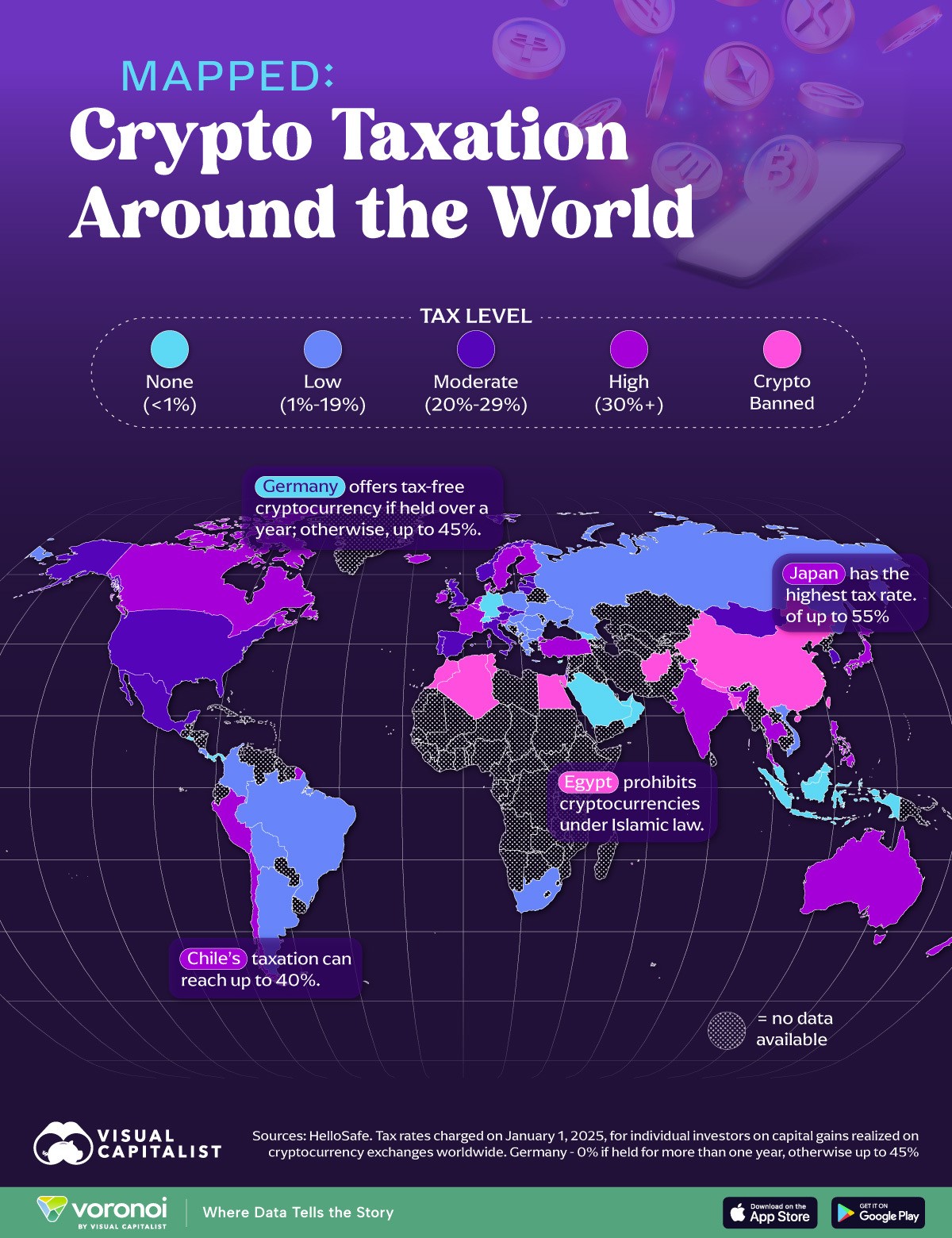

International experience: Taxation of income from cryptocurrencies in different countries is usually divided according to income level, with lower incomes subject to lower tax rates and higher incomes subject to higher tax rates, ranging from 0–10% (Switzerland, Malta) to 45% (Germany). The key threshold is income of €18,000.

Taxation of cryptocurrencies around the world (2025)

Thus, the adopted bill opens a new stage in the development of the virtual asset market in Ukraine, creating opportunities for the legalization of transactions and at the same time raising new questions regarding tax and regulatory conflicts.

AUB Information and Analytical Center

Sincerely,

The Ukrainian Banks Association Team

Have questions?

Contact us:

380 (44) 516-8775

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775