Financial sector news

Overview of international markets and finance as of September 1, 2025

- Source: Information and Analytical Center of the AUB

Several events could significantly affect all forecasts and trends in the near future: Donald Trump's illness, the Court of Appeals' decision on tariffs, and his attempt to dismiss Fed Governor Lisa Cook, an independent member of the Federal Reserve Board.

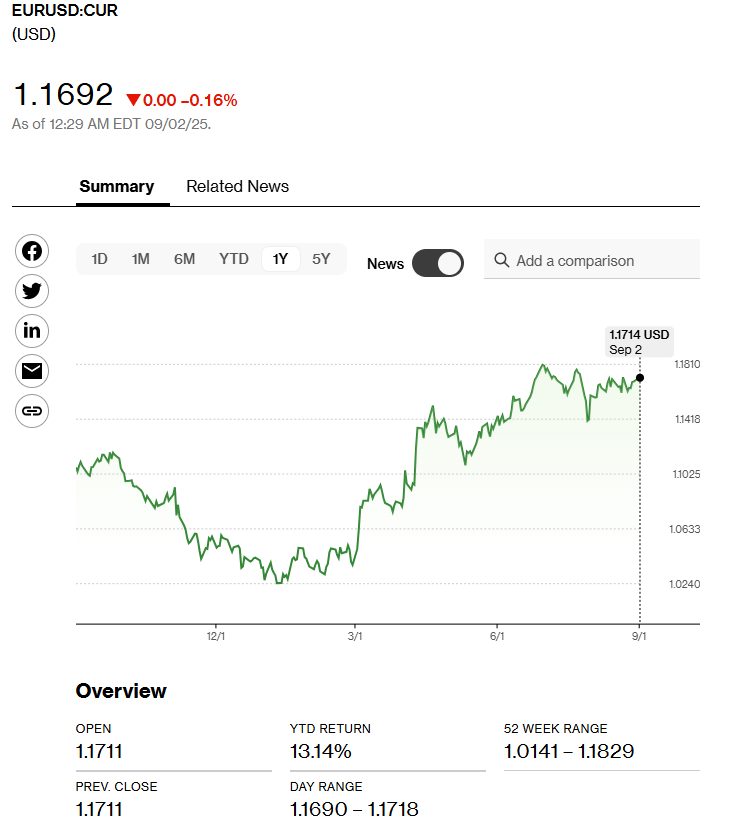

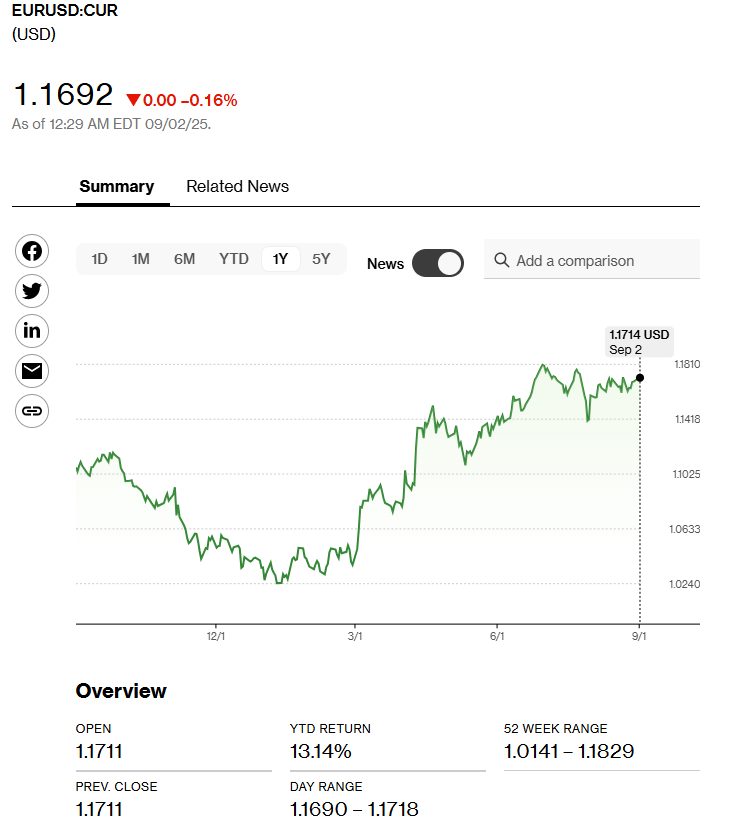

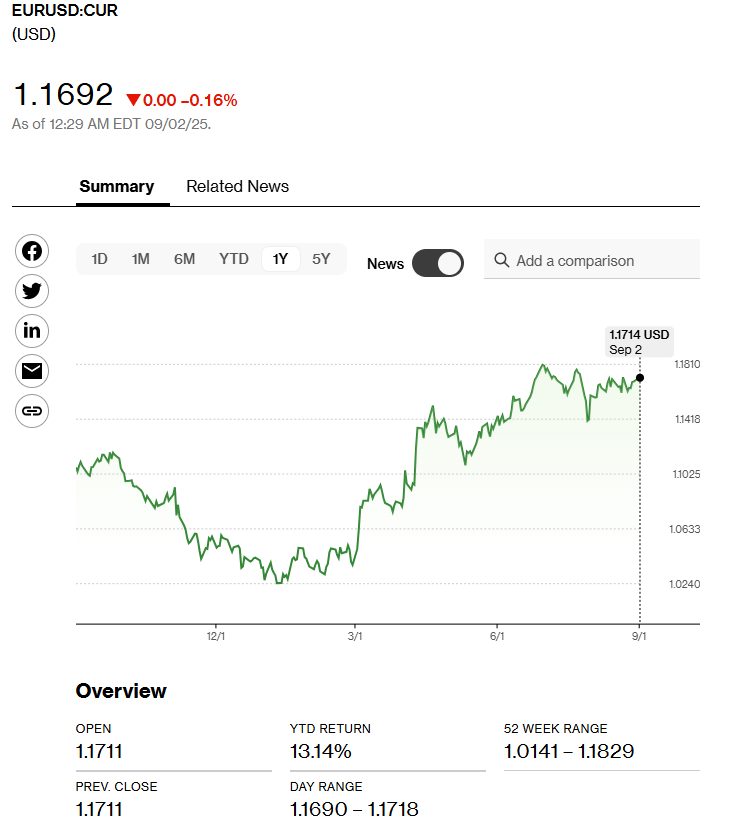

1. Currency

From the beginning of the year to September 1, the US dollar lost 13.14% against the euro. This weakens the position of importers and at the same time strengthens the competitive advantages of US exporters. During this period, the Chinese yuan fell by 2.13% against the dollar, and the Japanese yen by 5.99%. European exporters have suffered the greatest losses, while imports to Europe are becoming more profitable.

Forecasts for the dollar-euro exchange rate vary, but most point to a further strengthening of the euro. https://www.exchangerates.org.uk/, for example, expects the exchange rate to be 0.8777 by September 2025, 0.8683 by December, and 0.8595 by March 2026. According to Trading Economics forecasts, the EUR/USD exchange rate will be 1.16 by the end of the quarter and 1.15 in a year.

HSBC analysts note that the sale of the dollar is showing signs of a “bubble” that could eventually burst. The Bloomberg spot dollar index has fallen 8% this year due to US tariff policy and doubts about the stability of the dollar as a global reserve currency. HSBC predicts that the dollar will continue to weaken, but the arguments in favor of a sharp decline already seem one-sided.

2. Stock markets

According to Bloomberg, the annual return on investment in the S&P 500 index was 15.88%, and 9.84% since the beginning of the year. The EURO STOXX 50 index showed an annual return of 11.4% and 9.3% since the beginning of the year in euros.

Global stocks rebounded after falling in April following the announcement of new tariffs. They are now trading at record highs. The coming weeks will be crucial: the market is awaiting reports on employment, inflation, and the Fed's decision on interest rates. September is traditionally a weak month for US indices: the S&P 500 has lost an average of 0.7% during this period over the past 30 years.

3. Cryptocurrencies

As of August 31, Bitcoin was trading at $108,444, down 0.33% from the previous day. Over the past four weeks, it has lost 4.31%, but over the year, it has grown by 89.18%. Trading Economics forecasts indicate $106,560 by the end of the quarter and $99,829 in a year.

Until recently, experts' forecasts were positive amid Bitcoin's rise to $120,000 and the US Senate's GENIUS stablecoin package. There are still forecasts for growth of 14.7% in September and 13% in October this year. However, most forecasts are based on mathematical models rather than fundamental supply and demand factors.

4. Banks

On June 25, the ECB held its annual meeting with leading European banks. Main topics:

- Risks to financial stability. Key factors: geopolitical uncertainty, overvalued assets, cyber threats, and challenges from the development of artificial intelligence.

- Competitiveness. Europe lags behind the US in attracting private capital to innovative sectors. Bankers called for simplifying regulation, introducing a single capital market, and developing banking and investment unions.

The European Banking Authority (EBA) has published the results of a stress test of 64 banks, covering 75% of the sector's assets. Even in a scenario of severe recession, banks maintain sufficient capital levels (CET1 — 12%). At the same time, vulnerability to credit and market risks is increasing.

5. Economic situation

Eurozone

In Q2 2025, GDP grew by 1.5% (y/y), but the pace is slowing down. Growth of 1% is expected for the year. EU exports fell by 3.4% and imports by 7.1%. The trade surplus decreased to €26 billion. Inflation is stable at 2.0%, and since June, the ECB rates have been: deposits — 2%, loans — 2.15%, overnight — 2.4%.

Important news includes: adoption of the Omnibus package to reduce the administrative burden on businesses, discussion of the new euro design (to be introduced in 2027), and Bulgaria's entry into the eurozone in 2026.

EU–Ukraine. Ukraine Recovery Conference 2025. Key results:

- The European Commission has announced the creation of a €500 million European Flagship Fund for Ukraine's recovery.

- €2.3 billion in additional investments will be directed toward restoring housing, medical, and energy infrastructure, as well as supporting small and medium-sized businesses within the investment component of the Ukraine Facility.

- The World Bank is launching a new $200 million program to prepare state and municipal reconstruction projects, as well as providing a separate $50 million grant to support Ukrainian farmers.

- Japan is allocating $188 million for the green modernization of Ukrainian industry.

- The European Investment Bank will allocate €134 million for the restoration of transport infrastructure and another €200 million to support and develop Ukrainian hydropower.

- The Council of Europe Development Bank will finance a €100 million housing certificate program as part of e-Recovery and provide a €200 million loan to help internally displaced persons.

- Norway has launched a $200 million initiative to restore heating and water supply systems in Ukrainian homes.

- Switzerland will invest around €5 billion over the next 10 years in rebuilding various sectors of the Ukrainian economy.

- The UK will provide a $2.3 billion loan to strengthen Ukraine's air defense, and has also signed agreements between defense companies on joint production and cooperation.

United States

GDP grew by 3.3% in the second quarter. In July, personal income rose by 0.4% and consumer spending by 0.5%. Inflation remains at 2.6%. The Fed rate is 4.33%, and the average loan rate is 7.5%. Treasury bonds: monthly — 4.25%, annual — 3.7%.

According to Conference Board forecasts, the greatest impact of tariffs will be felt in the fourth quarter. The Fed is expected to resume cutting rates in December. Stress test results show that large US banks remain resilient even in a scenario of severe recession.

China

The economy grew by 5.2% in Q2 (y/y). Industrial production added 6.8%, retail sales — 4.8%. At the same time, deflationary pressures remain, and housing prices are falling. The People's Bank of China is keeping rates at 3.0% (1 year) and 3.5% (5 years), providing targeted incentives.

Despite a 24% drop in exports to the US, total exports have grown, allowing Beijing to support the economy. At the same time, risks of a slowdown remain due to deflation and the crisis in the real estate market.

International financial markets continue to experience high uncertainty due to political and geopolitical factors. The euro continues to strengthen, stock markets are showing resilience, bitcoin is fluctuating, and the banking sectors in Europe and the US are undergoing stress tests. Meanwhile, Ukraine is receiving large-scale support from international partners, which is creating the conditions for economic recovery.

Sincerely,

The Ukrainian Banks Association Team

Have questions?

Contact us:

380 (44) 516-8775

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775