Expert opinion

"Ukreximbank" demonstrated a record result of bad debt repayment in 2023 - UAH 2.7 billion

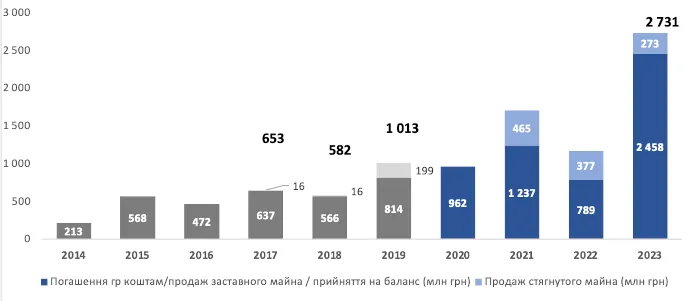

In 2022, the state-owned Ukreximbank was able to achieve debt settlement in the amount of UAH 1.7 billion, in 2023, the proactive position of Ukreximbank, the continuous work of the NPL division, despite all the existing obstacles, gave the bank a record result of repaying problematic debt — UAH 2.7 billion . told Member of the Board of Ukreximbank Dmytro Kaplyuk.

In 2022, the state-owned Ukreximbank was able to achieve debt settlement in the amount of UAH 1.7 billion, in 2023, the proactive position of Ukreximbank, the continuous work of the NPL division, despite all the existing obstacles, gave the bank a record result of repaying problematic debt — UAH 2.7 billion . told Member of the Board of Ukreximbank Dmytro Kaplyuk.

According to him, the amount of 2.7 billion soums is the largest indicator of problem debt settlement in the entire history of the Bank. In total, over the past 10 years, the repayment of problem debt amounted to UAH 10.1 billion. During 2020-2023, Ukreximbank received UAH 6.6 billion in repayment of problem debt, against 3.5 billion in 2014-2019. From 2020 In 2015, the Bank started selling foreclosed property on electronic auctions together with SE "SETAM". In total, seized property worth UAH 1.1 billion was sold, despite the fact that in the period from 2014 to 2019, the bank received UAH 231 million from the sale of seized property.

"For the stable repayment of NPLs, the bank adapted its strategy for working with problem debt to the new realities. Both classic tools for problem debt settlement and relatively new ones for state-owned banks were used for collection. In particular, we are talking about the sale of the right to claim on loans, the bank's participation as a buyer in auctions for the sale of property that is pledged by the bank, cooperation with collection companies to work with the debts of individuals, etc., - said Dmytro Kaplyuk.

|

The member of the Board of Ukreximbank singled out the following tools for working with NPLs:

- Restructuring. The restructuring tool not only provided more than UAH 0.5 billion of repayments (about 20% of the total amount of repayments for the year) in 2023, but also made it possible to preserve the business of the borrower companies, which continue to conduct operations, pay salaries to employees and pay taxes.< /li>

- Voluntary settlement. The total rate of voluntary debt settlement for 2023 was almost UAH 1 billion.

- Private performers. Thanks to cooperation with private executors, mortgaged property worth UAH 206 million was sold.

- Bankruptcy procedures. The professionalism of court practice specialists, including in the field of bankruptcy, was able to ensure the sale of pledged property in bankruptcy proceedings — during the year, pledged property in the amount of UAH 0.9 billion was sold.

- External legal advisors. Cooperation with experienced legal companies in the framework of forced debt collection of debtors who deliberately delayed the collection process, kept control over the collateral property, or property auctions were conducted in violation of procedures - the property was sold at a discount of up to 90% brought positive results.</li >

- Collection companies. Thanks to the work of the collection companies involved in working with the debtors of the retail business, the effectiveness of debt repayment of such debtors has increased 3 times (4.3 million UAH repayments thanks to cooperation with the collection companies).

- Realization of seized property. The Bank received UAH 270 million from the sale of seized property, despite the fact that among these objects were not only those acquired by the Bank in 2010, but also those that the Bank took from debtors less than a year ago.

Dmytro Kaplyuk emphasized that the settlement of problematic debts of debtors is a rather complicated and long-term process, since the unscrupulous actions of debtors and the existing shortcomings in the legislation lead to the prolongation of procedures and enable debtors to avoid responsibility .

The main problems in the collection of problematic debts remain legal problems, including:

- abuse on the part of arbitration administrators — transfer of pledged property to uncontrolled and unpaid use of third parties;

- abuse of arbitration managers and exchanges during auctions — manipulation of bids, non-admission of "unnecessary" participants, cancellation of bids, etc.;

- the imperfection of the current legislation of Ukraine in terms of protection of secured credit positionsitors (votes in creditors' committees, which influence the course of the procedure).

"With this in mind, Ukreximbank is actively working to introduce changes to Ukrainian legislation, in particular, to the Bankruptcy Code of Ukraine. Thus, during 2023, the bank was existing problems in the legislation were discussed within the professional community of FinClub Ukraine, relevant proposals were sent to the National Bank of Ukraine, the Cabinet of Ministers of Ukraine, the Ministry of Justice of Ukraine, etc. influence on the level of NPL in the banking system", where Ukreximbank proposed 12 changes to the Bankruptcy Code of Ukraine", summed up Ukreximbank Board Member Dmytro Kaplyuk.

Subscribe to our newsletter

Contacts

15, Yevhena Sverstyuka str.,

Kyiv, 02002 Ukraine

Email :

office@aub.org.ua

Phones:

+380 (44) 516-8775